It is very likely that 2019 will continue the trend of high volatility in the stock market – which was present for large chunks of 2018, writes Jay Soloff Friday. He's presenting at MoneyShow Orlando Feb. 7-8.

October through December were characterized by large moves in stocks, particularly to the downside. Now that we’re in 2019, we can probably expect more of the same, at least to start the year.

That’s not to say the market can’t get its act together in the next few weeks. However, there are several issues that first must be fully or partially resolved.

First off, the U.S. government is still shut down with no clear end in sight.

Of course, there’s the issue of the trade war with China, which could certainly drag on.

The Fed’s interest rate policy and Powell’s comments about the economy could cause plenty of volatility in and of themselves. For that matter, any major economic news could provide a spark.

And finally, we can’t ignore politics – both in the U.S. and the UK. There is plenty of drama that could erupt from the White House on any given day. Across the pond, the Brexit situation is fraught with uncertainty. And that’s not even talking about the other potential issues in the EU.

Bottom line, there are plenty of reasons to believe volatility (and a potentially downward bias) in stocks will continue in 2019.

So, what can you do to protect your portfolio? Hedging is certainly a good choice in this environment, but how do you protect yourself without spending a fortune?

One strategy you can use in this scenario is called a collar. A collar is a popular strategy used to protect downside risk in single stocks or indexes without having to spend a bunch of money. That’s because a collar uses a short call and a long put in combination.

A long put by itself is a perfectly reasonable way to hedge downside risk but puts can be expensive on their own. By selling a call against that long put, you can significantly lower the cost of your put in exchange for capping your upside potential. (The underlying asset will stop earning appreciation once it hits the short call strike.)

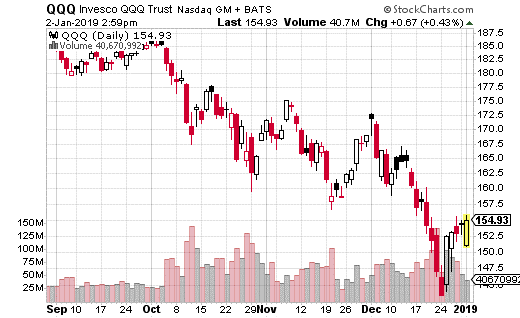

Let’s take a look at an actual collar that happened at the very end of 2018. This trade occurred in PowerShares QQQ (QQQ), a popular ETF which tracks the Nasdaq 100. That means the trader placing this collar is either long QQQ or owns several of the stocks which make up the index. (The Nasdaq-100 is pretty top heavy, so you can have a high correlation to QQQ by simply owning the FAANG stocks.)

Here’s the trade…

With QQQ at $154, the March 15 170 call was sold while at the same time, the 140 put was purchased. This was done 10,000 times for a total cost of $1.70 or $1.7 million in premium. Now, just because the collar caps the QQQ gains at $170 doesn’t mean this is necessarily a bearish trade.

You see, the position allows the long QQQ position (or basket of stocks) to make about 10% upside before hitting the cap. 10% in 3 months is still a nice amount of upside. Meanwhile, if stocks drop about 10%, the 140 put kicks in protecting any further downside.

Keep in mind, the max loss on this trade is the premium spent, or $1.70. Without the short call, it would be over $3.00 per put instead. The call will expire worthless at any point below $170, and that premium is used to offset the cost of the 140 puts. Above $170, the calls are countered by the long stock, which is why it’s a cap.

I think this a great way to protect your portfolio if you don’t want to spend a ton of money on puts. You are capping your profits, but potentially earning a 10% gain in your portfolio in 3 months is hardly being overly conservative. If you have a lot of tech exposure in your portfolio, this is a trade you may want to seriously consider.

— Jay Soloff

Subscribe to Jay Soloff's Options Profit Engine here…

Watch Jay Soloff: New options trading trends.

Recorded: TradersExpo Las Vegas, Nov. 13, 2018.

Duration: 4:41.

Watch Jay Soloff: 3 simple steps you can take right now to trade volatility like a pro.

Recorded: TradersExpo Las Vegas, Nov. 13, 2018.

Duration: 38:22.

Watch Jay Soloff: Successful Options Trading.

Recorded: MoneyShow San Francisco, August 24, 2018

Duration: 3:31.

Watch Jay Soloff’s Interview: How I Trade Volatility.

Recorded: TradersExpo Chicago, July 24, 2018.

Duration: 5:46.