Houston-based Cheniere Energy (LNG) is showing a strong technical set-up a week in front of its quarterly earnings report, writes Elizabeth Harrow.

Houston-based Cheniere Energy (LNG) is due to report earnings before the market opens Thursday, May 9. The stock has been on a post-earnings hot streak over the last year, with LNG shares closing higher the session after earnings in three of the last four quarters. Significantly, it was last year's early May earnings report that triggered the biggest earnings-related rally for LNG, with the stock adding 5.9% the day of that release.

Ahead of this upcoming event, the stock is sending up buy signals on the charts. Data from Schaeffer's Senior Quantitative Analyst Rocky White shows that LNG is trading within one standard deviation of two historically significant trendlines -- suggesting the cards could be stacked in favor of a short-term bounce.

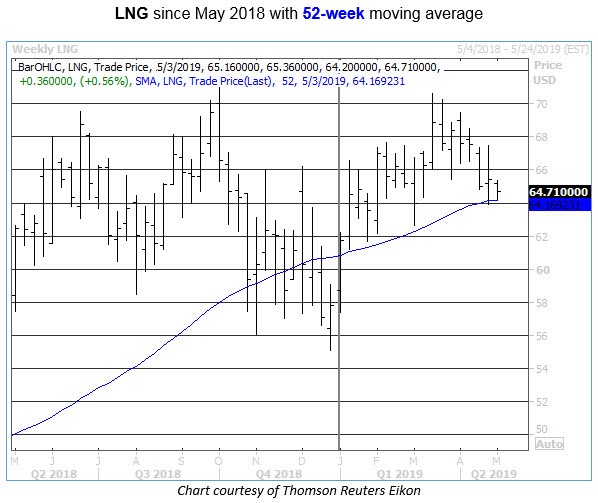

In addition to re-establishing a foothold above its benchmark 200-day moving average in 2019, LNG just pulled back to perch atop its 52-week moving average (see chart below). The stock is in its 18th week trading above this trendline, and previous such pullbacks to support here have yielded bullish short-term returns for Cheniere stock.

Specifically, after 18 prior signals, the stock has delivered an average return of 6.13% over the next four weeks, with 72% of the returns positive. Based on LNG's current perch at $64.71, that would place the shares around $68.67 this time next month -- on pace to revisit their 52-week highs north of the $70 level.

LNG is fresh off a check-in with its 10-month moving average, as well. Pullbacks to support at this trendline have occurred 10 previous times in the past 15 years, and the average four-week return afterward is 7.18%, with 80% positive. With these two buy signals going off simultaneously, the chart setup for LNG looks appealing right here.

That said, with earnings right around the corner, it's a bit troubling to note (from a contrarian perspective) that short interest on LNG has dwindled to around nine-year lows, with only 2.76% of the equity's float now sold short. It would still take a respectable 4.2 days to cover all of these shorted shares, at the stock's average daily volume -- but again, it's extremely rare for LNG bears to make themselves so scarce.

What's more, 11 out of 12 analysts tracking the shares already call them a "strong buy," with one "hold" rounding out the ratings. With so much optimism priced into LNG already, the likelihood of a major upside surprise this time around appears slim.

Options traders are pricing in a bigger-than-usual move, though. Over the past eight quarters, Trade-Alert notes that LNG has registered an average one-day post-earnings price swing of 2.7%, regardless of direction. Ahead of the May 9 first-quarter report, the options market is pricing in a 4.4% one-day move for LNG.

Given the decreased odds of a major upside surprise, based on the current sentiment landscape, as well as the increased odds of a post-event volatility crush for buyers of those pricey options, we'd recommend keeping LNG on your watchlist for now -- at least until after the earnings report. If the results are reasonably well-received, or even if the stock simply manages to hold support, look to play a post-event follow-through move higher as continued short-covering tailwinds help the shares capitalize on these reliable trendline buy signals.