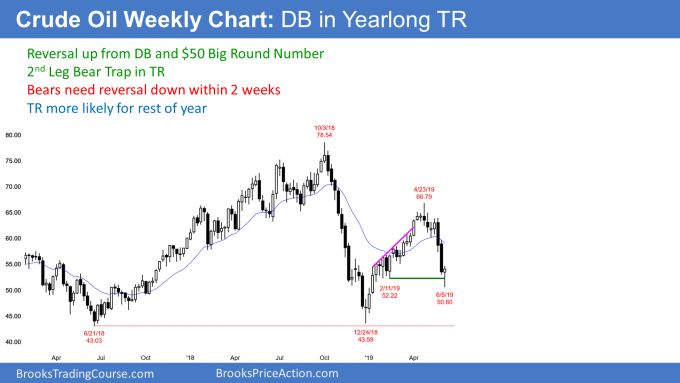

Crude oil futures are in a sell climax at support, writes Al Brooks.

The crude oil futures market tested the Jan. 14 low and $50 last week. Because of the parabolic wedge sell climax, there will probably be at least a couple weeks of profit taking soon.

Crude oil futures are in a sell climax at support. In mid-April, I said that the bull trend would soon reverse and test support below $58 and possibly all of the way down to the Jan. 14 low. Last week poked below that low and bounced a little (see chart).

I chose that low as a target because it was the first pullback in the strong reversal up from the extreme sell climax of late 2018. That initial rally was the spike in a Spike and Channel bull trend. The channel began with that low.

Since 75% of bull channels have bear breakouts, traders should consider every bull channel to be a bear flag. Once there is a breakout below the bull trend line, the selloff often tests down to where the channel began, hence the focus on the Jan. 14 low.

Bull channels evolve into ranges

Yes, this selloff has been strong. However, during the bull channel, it was clear that the channel would have a bear breakout and a deep reversal down. The rally would end up as a bull leg in a trading range that could last a year.

Now I am saying the opposite. The selloff since April 23 is probably just a bear leg in the developing yearlong trading range. It is a second Leg Bear Trap. The first leg was the three-bar selloff from the April 23 high. The second leg down probably ended this week. It is a bear trap because the bears expect it to lead to a bear trend. More likely it is either the end or near the end of the selling.

Trading ranges have legs up and down. This leg down will end soon and it might have ended last week.

There are a few reasons for this. First, it tested the start of the bull channel, which often leads to a trading range.

Next look at the price action in the selloff on the daily chart (below). There was a collapse on May 23 and then a second two-day sell climax on May 31. A strong breakout typically has at least a small second leg down. The one-day selloff on Wednesday might be the second leg down from that May 31 selloff.

It is also the third leg down in the three-week strong bear breakout. Three legs down in a tight bear channel is a parabolic wedge sell climax. It usually attracts profit takers, especially when the selloff is also a test of major support.

Profit-taking likely soon

If a bear takes profits in a big bear trend, he will not look to sell again a bar or two later. That does not make sense. If that was his thought, he would simply hold short. Therefore, if Thursday was the start of profit-taking, the bulls who take profits will wait to sell again near resistance, likely around the 20-day exponential moving average.

A profit taking rally often continues up to the top of the most recent sell climax. That is the May 30 high, which is just below the $60 Big Round Number.

The bears also want to give the bulls a couple chances to reverse the bear trend before selling again. Therefore, a profit-taking rally typically has at least two legs and lasts about 10 bars or more.

Since profit-taking is likely soon, the odds favor at least a couple weeks of sideways to up trading. Furthermore, the downside from here is probably small after consecutive sell climaxes down to support.

Trading Room

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed E-mini price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a two-day free trial.