Recent extreme weather is not just a Midwest United States story, it is affecting the whole world and will have a long-term impact on agricultural markets, writes Shawn Hackett.

We have warned about the increased weather volatility that was going to take place as we entered the first Grande Solar Cycle Minimum in more than 200 years that started in 2018. We have discussed in past reports that especially at the trough periods of the solar cycle, where we find ourselves now, that the weather volatility is most extreme and where the El Nino and La Nina pacific sea surface temperature phenomena are amplified beyond historical precedent.

We have certainly experienced exactly that with the record wet, cold winter/spring season in the United States this year which has exceeded all other cool wet El Nino responses in the past. So long as the atmosphere is responding strongly to the El Nino sea surface temperature regime, we should expect this cool, wet pattern to continue into July as our work suggests it will.

Ongoing excessive wet weather will continues to bid up the grain markets as concerns over yield potential will meet up with fears over increasingly reduced planted acres to bring the U.S. grain balance sheets down. Conversely, Canada is in severe drought and will likely remain in this condition into July adding additional North American grain production concerns.

As we look overseas, the situation is just beginning to develop. A weak El Nino with a strong atmospheric response (with the strong upper Global Winds as an indicator) should offer the opposite extreme that we are seeing in the United States. Instead of excessive wet conditions, we can expect Asia in general to see excessive dry conditions with the only exception being south China where floods will be pervasive.

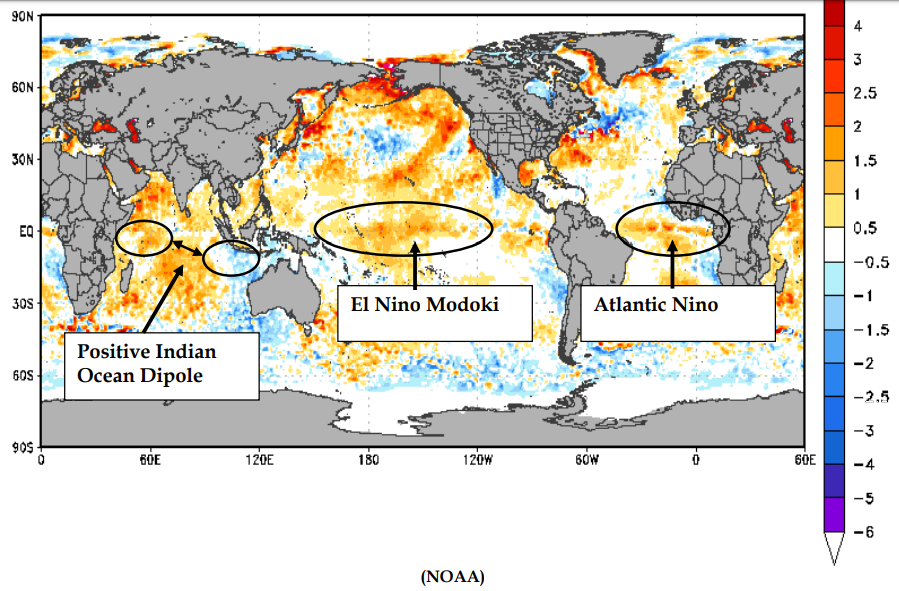

Not only is this an El Nino year but it is also turning into an El Nino Modoki. This is when the warmer than normal pacific sea surface temperatures are concentrated in the middle of the pacific instead of to the East. This has tended to amplify the dry conditions in Asia especially in India and China but also in Australia, Indonesia and Malaysia.

Additionally, we are in a moderately positive Indian Ocean Dipole which means warmer western waters over the Indian Ocean versus eastern waters which tends to further deprives East Asia of moisture (see chart below). On top of this, we also have the development of an Atlantic Nino which is warmer than normal sea surface temperatures to the south of West Africa which tends to suppress West African moisture for cocoa and further depresses the Indian monsoon flow.

The bottom line to all of this is that weather should remain very bullish for global Ag markets heading into late summer.

On top of this, we have the African Swine Fever that has caused the greatest meat protein shortage ever seen that will reach epic proportions this fall and are now seeing the uncontrollable spreading of the Fall Army worm all throughout Asia adding additional production threats beyond just weather.

As we have been warning about, we feel the greatest bull market in Ag history has just started that will reach a crescendo in the 2021/2022 growing season when an amplified La Nina weather pattern, meets up with the Grande Solar cycle Minimum trough.

While grain markets are getting all the attention right now given adverse U.S. weather problems and while problems overseas are supportive to grain markets longer term, we would be focused on markets like cotton, rice and sugar where India, China and Indonesia weather problems could surface.

Given that we have Smart Money Buy signals in both cotton and sugar at the moment those would be our preferred markets for new purchases at this time.

Please take the time view the following charts and commentary for further illustration of these points. Also, be sure to read out discussion on the corn market and how to view Smart Money within the context of an historical asymmetrical weather market.

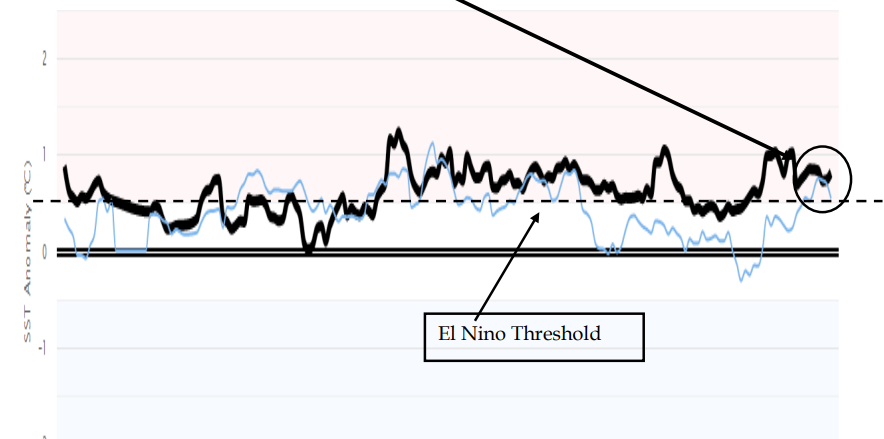

El Nino

El Nino Remains in Place and should do so for the duration of the Northern Hemisphere Growing Season. Also Notice that is has become an El Nino Modoc as featured in the light blue line. This should continue to offer cool wet weather for the US Midwest and drought risks to Asia.

Shawn Hackett, President Hackett Financial Advisors, Inc. hackettadvisors.com