We may be entering the edge of chaos for markets, reports Joe Duarte.

The edge of Chaos is increasingly active. Just as the ink was drying on the U.S.-China trade pact, fears of a global Coronavirus pandemic originating in China have emerged, providing the catalyst for selling stocks and buying bonds on Wall Street.

For the last couple of weeks, I’ve noted that the Markets – Economy – Life Ecosystem (MEL) seemed to be heading toward a decision point; an excuse to sell increasingly overbought stocks. In fact, last week’s market summary stated that the odds of a minor, 3% to 7% pullback, in the stock market were increasing.

And while we may have started that correction process last week, with the Coronavirus potential Black Swan event as the catalyst, it’s worth asking if this viral pandemic scare can overwhelm the Federal Reserve’s repo market undercover QE 4 process which has lifted stock markets to record highs. Moreover, if things do worsen rapidly, what will happen if all global central banks ease even more aggressively and the markets continue to sell off?

It certainly seems that this virus is a very nasty infection, and that the Chinese government seems to have been caught on its back foot. So, the headline reading algos don’t know what to do other than sell. Specifically, and although it is very early in the situation, there are yet no signs of containment of the virus and that it’s spreading all over Asia and the world, with confirmed cases in France, Australia, Malaysia, Thailand, Canada and the United States.

Even more alarming, a computer simulation of a Coronavirus pandemic conducted at Johns Hopkins University in late 2019 predicted that there could be as many as 65 million deaths worldwide within six months if the virus is not contained. The point is that we are now close to falling out of the edge of chaos and into chaos itself as the algos follow their programs. Furthermore, beyond the cost in lives, the questions for investors over the next few weeks are:

- What does it say about, the markets, the economy and life itself (MEL) if the Coronavirus can beat the lure of easy money?

- More important what does a potential pandemic of this nature, if it comes to fruition and it can’t be contained, say about the state of the world’s health care systems and the ability of governments to function as caretakers of the public interest?

Watch Housing & Semiconductor Stocks

Investor confidence took a hit on Jan. 25, 2020. If the Coronavirus is not contained, we may see a contagion effect throughout the U.S. economy as passive investors, especially 401 (k) plans feel the pain of what could be a real bear market and hit the sell button. Of course, it’s early, but even stocks of companies with good stories, including a trio of bellwethers: Texas Instruments (TXN), Applied Materials (AMAT), and KB Home (KBH), described in more detail in tomorrow’s report.

Clearly, the dramatic reversals in these three stocks suggest that the current economic expectations may have to be reconfigured, in the face of a potentially escalating flu pandemic around the world. This is even more concerning as recent U.S. economic data has been mixed as exemplified by PMI data released last week for both the service and manufacturing service.

Furthermore, the bond market hasn’t been buying the tale of economic strength that some have attributed to rising stock prices. In fact, the U.S. 10-year note yield (TNX) is trading near 1.7%, which suggests bond traders are predicting a severe decline in economic growth.

Yet, with the Federal Reserve on hold, and likely to be secretly leaning toward more easing as key sectors of the economy decide whether to respond to positive supply and demand scenarios or to give in to fears of the unknown, investors should be watching developments closely in the next few days.

The answer is maybe; since the Markets, the Economy, and Life (MEL) are now one interconnected system. In fact, over the last four months as long as interest rates have remained favorable, and the news has been manageable, the odds have been on the side of the bulls. This has been spurred by imbalances in supply and demand in certain sectors of the economy, such as housing.

That said, however, if things truly unravel in China, which is a huge unknown at the moment, and the virus truly becomes uncontainable the bullish story could unravel as 401 (k) plans, and their wealth effect are central to MEL and their willingness to take financial risks based on their expectations of their future. If the stock market breaks and triggers a panic, directly via individuals selling, or indirectly via algo selling, then the negative repercussions will ripple through the entire system, and the odds of a recession, and perhaps worse may rise.

NYAD Rolls Over

The New York Stock Exchange Advance Decline line (NYAD) finally rolled over this week, signaling that the market is heading for some sort of correction. This, coupled with the fact that the Relative Strength Index (RSI) for NYAD has been above 70 for several weeks, means that the rally is likely over for now, barring something very positive happening to spur prices higher.

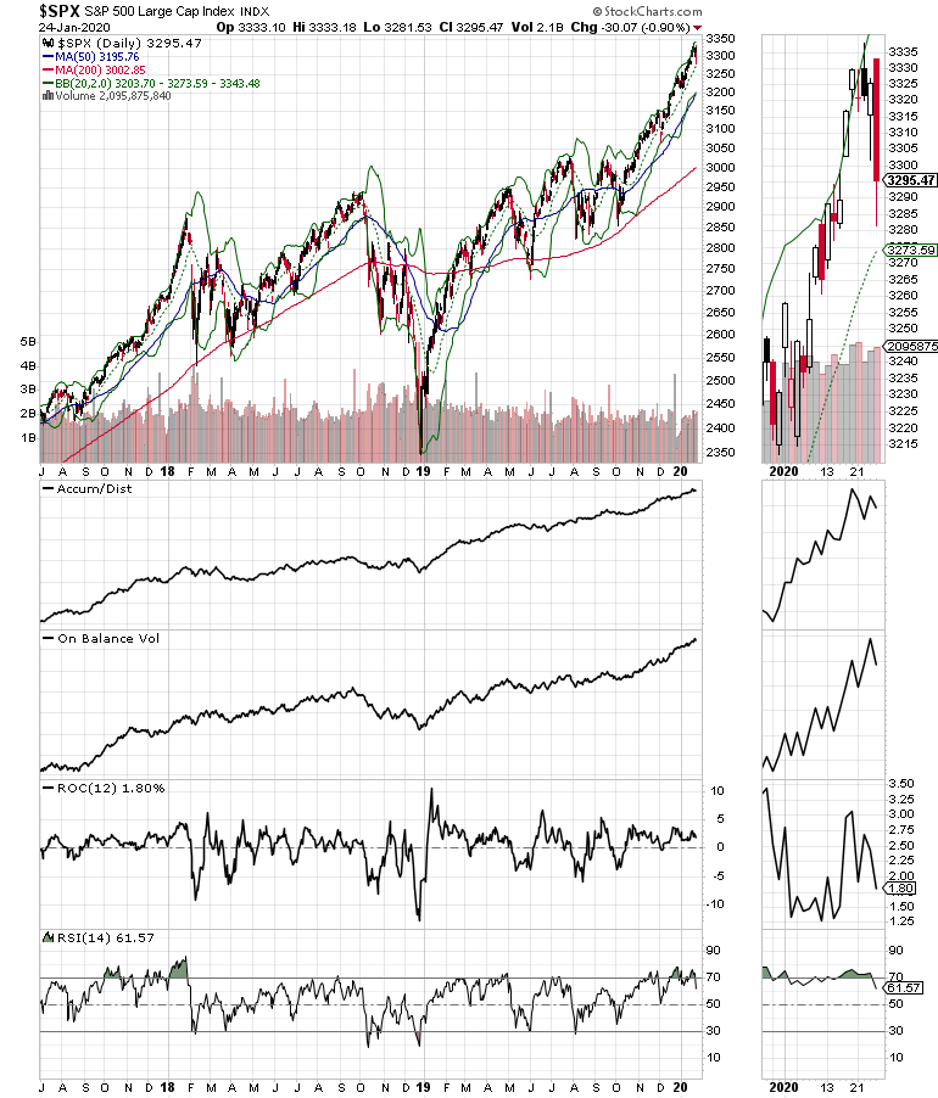

Elsewhere both the S&P 500 (SPX) and the Nasdaq 100 (NDX) indexes seized and reversed after early day gains on Friday. Both benchmarks seem destined to test short term support (20-day moving averages) and intermediate term support (50-day moving averages) soon.

If the indices and the NYAD break key support levels we may see a move back toward the 200-day moving averages, which are roughly some 10% to12% below the Jan. 24, 2020 respective closing prices. Finally, here are some key support and indicator levels to watch:

- NYAD 20- and 50-day moving averages

- RSI 50 for NYAD

- NDX and SPX 20- and 50-day moving averages

- RSI 50 levels for both NDX and SPX

Shorting this Market is Tempting but May be Dangerous

This is a dangerous time, and although the stock market looks vulnerable and the thought of shorting it is tempting, it’s probably not a good idea, at least not yet. This is because given the speed at which algos can reverse course you may suffer big losses on the short side. Therefore, a better alternative is to raise cash, to build a shopping list for the next rally, and to just wait on the sidelines until things clear up.

Joe Duarte is author of Trading Options for Dummies, and The Everything Guide to Investing in your 20s & 30s at Amazon. To receive Joe’s exclusive stock, option, and ETF recommendations, in your mailbox every week visit here.

Join Joe at the MoneyShow Orlando Feb. 6-8 where he will be discussing the ins and outs of the Markets-Economy-Life ecosystem (MEL) and how he uses it to pick winning stocks.