Interesting options trade on DraftKings that has a major investor that may allow it to last the current shutdown in sports, writes Jay Soloff.

Gambling on sports has always been popular but controversial in the United States. What once was the sole provenance of casino sports books and those with bad habits and a connection, has become far more widespread in recent years. Many states are have passed legalized sports gaming and many more are expected to adopt it soon.

Even before the debate over online sports gambling became mainstream, there was the debate over daily fantasy sports. Fantasy sports has been a popular pastime in the U.S. (and doubtless elsewhere) for decades. But, daily fantasy sports is a more recent phenomenon, gaining popularity over the last decade or so.

In a nutshell, daily fantasy sports allow customers to “buy” certain sports players on a daily basis, with the ability to win money if those players performed well in their games that day. The big players in the industry are DraftKings (DKNG) and FanDuel. DraftKings recently went public through a reverse-merger, while FanDuel was acquired by a European sports-betting company.

Daily fantasy sports got so popular, with so much money changing hands, that it became a major concern to state governments. States then had to decide if this type of fantasy was actually closer to gambling than fantasy sports. Ultimately, changes were made to the industry to make it more competitive for the average customer.

Moreover, daily fantasy sports became almost an afterthought once the door opened to the potential for legal online sports betting. In fact, DraftKings and other fantasy sites have their own sports betting features in states where it’s legal.

The question is, is DraftKings stock worth buying? Well, George Soros certainly thinks so. It was just disclosed that Soros' fund owns about $70 million worth of the fantasy sports platform’s stock. The news drove the share price to all-time highs and a market cap of more than $18 billion.

Options action also appears to be heavily bullish for DraftKings. On the day of the Soros announcement, 90% of the action was considered bullish. The five-day average was 82% bullish. Clearly, the stock has gained some attention.

Looking at the trades themselves, there were several smaller blocks of calls purchased. Most of these trades were short-term in nature, with earnings coming up on May 15.

(DraftKings posted a net loss of $68.7 million (18¢ per share). The FactSet consensus was for a loss per share of 15¢ and revenue of $104 million.)

For instance, with the stock between $25 and $26, about 1,500 May 15 30 calls were purchased in three blocks.

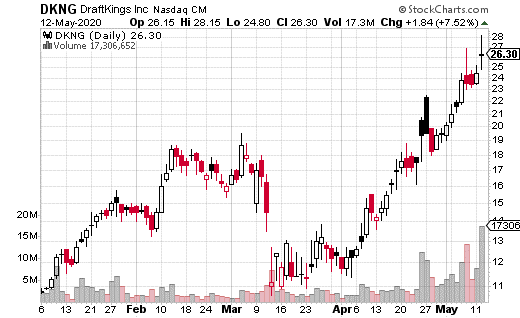

Glancing at the chart, it's easy to see why investors are excited about DraftKings’ stock. Of course, it helps that Soros is a big buyer of the shares (along with a few other big names from the sports world).

What doesn’t help is that sports—particularly American professional sports and major college sports, have been shut down due to the Coronavirus pandemic. Having a long-term player such as Soros involved is a plus, but the big question is when will sports return and will the typical gamblers have the disposable income to play given the economic hit everyone has taken.

The other red flag (besides the unsustainable exponential stock move and the fact that currently there is no product) is the lack of substantial block trades. Smaller blocks aren't as convincing of a signal as the really big, institutional block trades. Those tend to be in the thousands or tens of thousands.

Still, DraftKings isn't a bad choice for a directional flier. The options are still new, and big players may we waiting for more liquidity. It could also be interesting to see what earnings look like going forward after the company’s recent entry into the public markets through reverse-merger.

Jay Soloff is the Options Portfolio Manager at Investors Alley. He is the editor for Options Floor Trader, an investment advisory bringing you professional options trading strategies, with all the bells and whistles of Wall Street, but simplified so all you have to do is enter the trades with your broker.