Despite a spike in Covid-19 cases, there are signs of economic optimism, reports Adam Button.

Florida grabbed headlines to start the week with 15,300 new cases of Covid-19, the highest of any state since the pandemic began. But below the surface there are signs of optimism.

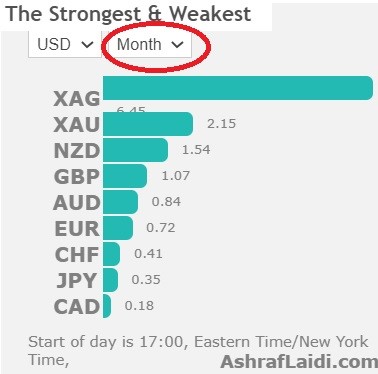

Silver and gold are leading against the U.S. Dollar, while the British pound (GBP) and Japanese yen (JPY) lag. We also cite a recent recurring pattern in the U.S. dollar/Chines yuan (USD/CNY) below. U.S. stock index futures are up after Pfizer (PFE) and BioNtech (BNTX) got fast track status for two of their Covid-19 drug treatments.

The Commodity Futures Trading Commission’s (CFTC) Commitments of Traders (COT) data showed more speculators buying the euro. Below is the performance for FX and metals against the USD since the start of the month.

U.S. handling of the Coronavirus has undoubtedly been a failure but the trend in the virus in other developed countries shows it can be tackled. Ultimately, the United States will get there and took a big step on Saturday as the President wore a mask publicly for the first time.

In terms of data, the Florida number also wasn't as bad as the headline. The 35% jump in cases came on a 60% increase in the number of tests. As a result, the positivity percentage fell to 11.25% from 12.6%. In Arizona, Texas and California there are early signs of a leveling off in cases and people are undoubtedly practicing better social distancing.

While hospitalizations and deaths will likely rise through month end, there is a narrow window for the United States to lower cases enough by September to successfully open schools.

Pfizer also stoked some optimism with the pharmaceutical company's CEO saying a vaccine could be approved in October. After a 1% gain on Friday, S&P 500 futures started the week higher.

The challenge for traders (especially those trading off indices) is to maneuver between the news of rising U.S. virus cases and improved chances of finding an effective vaccine.

FX & Dollar/yuan

With regards to FX, Ashraf is cautioning on the Chinese yuan's rally past the 7.0 level (USDCNY drops below 7.0), suggesting a key inflection point in the USD's next leg down. Recall how last year the 7.00 resistance in USD/CNY proved a stubborn barrier in the face of USD bids, until its break helped paved the way for rapid USD gains against most of currencies.

The focus will remain on the virus this week with a very light economic calendar. Be advised that most states tend to report the weekly low in virus numbers on Mondays due to weekend testing bottlenecks. That's a factor the market should be better at pricing in, but it continues to work.

CFTC COT Data

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.

EUR +104K vs +98K prior GBP -16K vs -21K prior JPY +17K vs +24K prior CHF +4K vs +4K prior CAD -17K vs -21K prior AUD -1K vs -3K prior NZD 0K vs 0K prior

Euro longs dropped 20K two weeks ago but had a small bounce last week. Aside from that position, the speculative market is reluctant to pile into anything.

What's Special about the WhatsApp Broadcast Group? The WhatsApp Broadcast Group consists of more frequent trade ideas and updates as well as signaling to members that Ashraf will be issuing a new trade action to the general Premium clients. In each of the winning Premium trades of the past five weeks (gold, silver, EURUSD, DAX), Group members were able to make more gains due to extra guidance via WhatsApp. Sign up through the link above.