Joe Duarte breaks down the myths and opportunities in today’s Covid/Fed centric markets.

With the month of August come the dog days on Wall Street, which traditionally means low volume and sluggish markets. Unfortunately, when the algos see low volume and few bids, the market often slides in big chunks, so this may be a very tough August.

Accordingly, unless we are truly near the ultimate top for the longest bull market in history, investors who continue to analyze the market based on metrics of the past will continue to be bearish and miss whatever time is left in this ongoing bull market. Happily, investors who dig deep into company fundamentals, management moves, and crucial technical indicators, are more likely to be rewarded. And this is even more true in a market where the Federal Reserve continues to pump money into the banking system.

Last week, in this space I wrote: “For investors, at least in the present, it’s not what the economy can do to the markets that matters most. Instead it’s what the Fed can do to the markets, to 401(k) plans and to trading accounts that should keep us up at night,” while adding “we are in a new world, where in a complete reversal of traditional relationships, the markets are driving the economy and the Federal Reserve and global central banks are driving the markets.”

By and large, nothing has changed.

Familiar readers know about the complex adaptive system composed of the markets, the economy and people’s lives (MEL), so I won’t dwell on the fact that its existence is self-evident. What I will note, however, is that over the last several months, I’ve described a series of influences on the market, which now are asserting their effect on stock prices in a more decisive fashion and which have turned the economic apple cart upside down and have placed the stock market as the leading influence in MEL.

These influences are best grouped in “the big five” macro influencers:

- Covid-19

- The Federal Reserve

- Demographic milestones

- Retirement and trading accounts

- High Frequency Algos

Specifically, while traditionally most stocks fall in tandem during periods of economic hardship, the combination of the influences described above has changed the playing field requiring a different analytical approach to stock picking. In fact, the whole stock picking dynamic has been further turned upside down as the market adapts to the evolving dynamic of the Covid-19 pandemic and the Federal Reserve’s response to the economic collapse caused by the shutdown.

Moreover, as the stock market now rules MEL’s roost, we now live in a world where bull and bear markets may coexist depending on how the interaction between the markets, the economy, and people’s lives shake out for individual sectors and stocks. Indeed, the final cog in the machine is the machine itself, the high frequency trading (HFT) algorithms, whose instant reaction to headlines can change any market trend instantaneously.

What it all boils down to is that success in this market requires a working knowledge of how these five influences affect stock prices and how to best decipher and manage them.

In a Bipolar Market Follow the Money

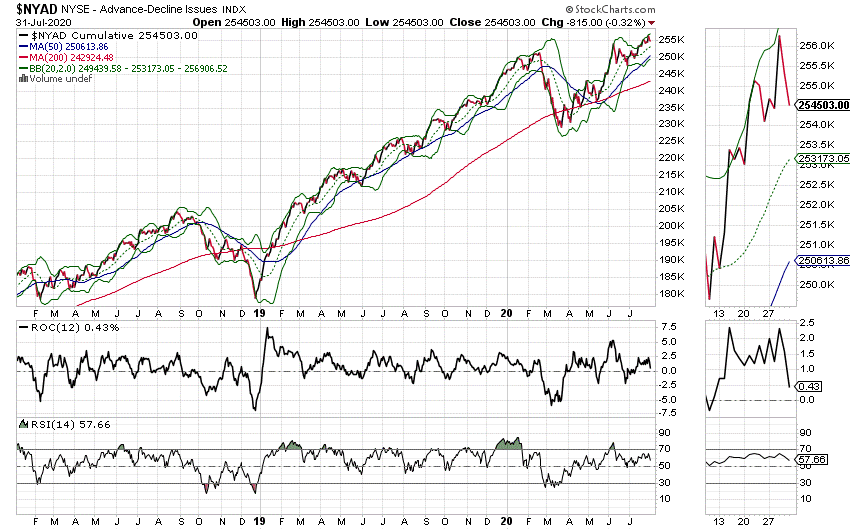

It’s foolish to believe you are in a bear market when the New York Stock Exchange Advance Decline line (NYAD), as I describe below, makes new highs on a regular basis. Indeed, by definition, when the NYAD is moving higher, it’s due to the fact that more stocks are rising than falling.

That said, these are not normal times, thus successful stock picking requires a wide ranging and in depth analysis of the market and individual sectors and stocks on a regular basis. For example, if you limit your analysis to ETFs, such as the Healthcare Select SPDR Fund (XLV), you would correctly conclude that healthcare stocks have been in an uptrend until recently.

Yet a more in depth analysis would reveal that not all stocks in healthcare are in a rising channel. Indeed, if you owned shares of pharmaceutical giant Glaxo SmithKline (GSK), you would be lagging the market while if you owned shares of biotech equipment and materials manufacturer Repligen (RGEN), a stock I recently recommended, your only question at this point would be how much of a profit should I take and when should I take it?

Tomorrow, in “A Tale of Two Healthcare Stocks,” we will discuss their performed diverged and why.

NYAD Remains in Uptrend

The New York Stock Exchange Advance Decline line (NYAD), until proven otherwise, remains in a stubborn uptrend despite the market’s daily gyrations; and those investors who do their homework will reap the greater rewards in this market (see chart).

Still, the short term action in NYAD suggests that some sort of pause may develop over the next couple of weeks. Thus, and although the risks at this point are low, investors should beware of the possibility of a Duarte 50-50 sell signal appearing. And just to refresh memories, a sell signal is generated when NYAD falls below its 50-day moving average at the same time the relative strength index (RSI) indicator falls below 50.

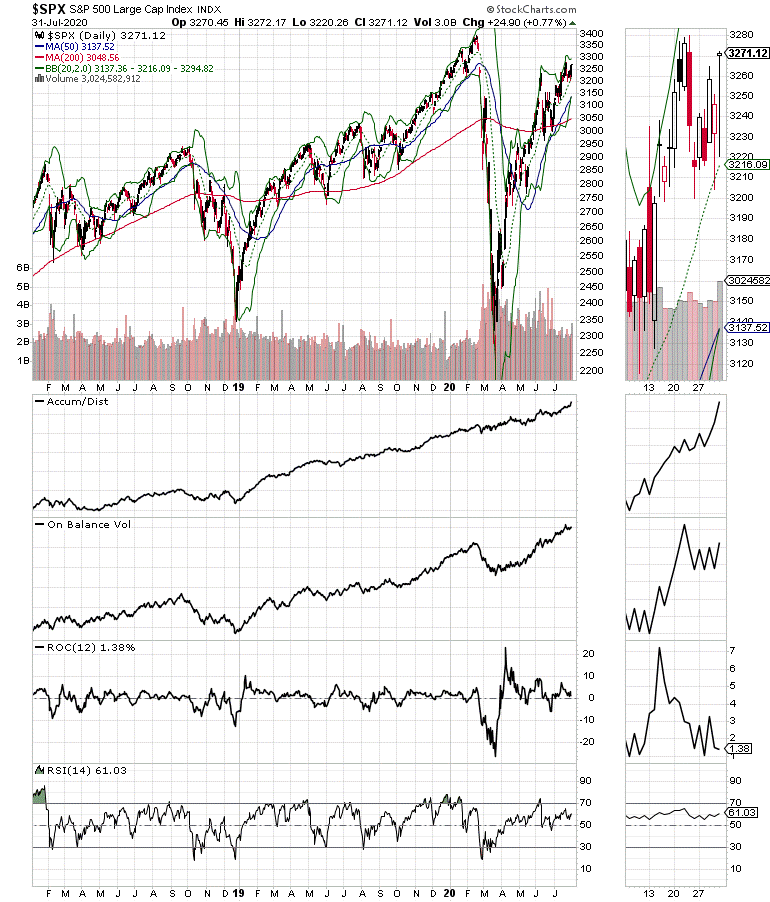

The S&P 500 (SPX) also looks set to embark on some sort of consolidation pattern. On the positive side, SPX remains above its 20-, 50- and 200-day moving averages although On Balance Volume (OBV) is a bit on the weak side in the short term.

Joe Duarte is a former money manager, an active trader and a widely recognized independent stock market analyst since 1987. To learn to trade options with less risk buy a copy of my bestselling book “Trading Options for Dummies.” Click here. To find out more about stocks that should benefit from the MEL phenomenon consider a FREE trial to Joe Duarte in the Money Options.com, click here. And check out my latest edition of Stockcharts.com’s Your Daily Five, titled “Five Stocks with Explosive Potential” where I reveal five stocks that are poised to benefit in a big way from the latest trends in MEL.