When it comes to the stock market investing, there are indeed dozens of different strategies to use, so it might be confusing for beginners says Konstantin Rabin.

However, most of those techniques fall into one of the three categories: growth, value, and income investing.

The value investing looks at those stocks, which for whatever reason are currently undervalued. The main idea here is that by purchasing those stocks at a discount, the market participant might be well-positioned to benefit from the potential capital appreciation in the future.

The growth investing focuses on identifying and purchasing those stocks, which have performed quite well in the past and have the potential to achieve a high rate of earnings in the future.

Finally, there are people who are investing for income. This strategy looks at the stocks of those companies, which paid consistently increasing dividends to their shareholders over an extended period of time. Dividend investors also take a look at the payout ratio of the firm, in order to determine whether the firm is in a position to sustain those payouts.

Obviously, there is no such thing as a single best strategy for the stock market. Each of those methods described above has its advantages and disadvantages. So, the choice between them depends on the financial circumstances and goals of the individual. Let us go through each of those strategies in greater detail.

Value Investing Strategy

One of the most common methods for stock trading is value investing. The basic mechanics here are quite simple. The fact of the matter is that at any given time, there are always some stocks that trade below their fair value. One of the most famous methods of stock valuation is so-called the price-to-earnings ratio, also known as the P/E ratio.

This ratio is measured by dividing the current market stock price by the earnings per share indicator, also known as EPS. Now, the general rule of thumb with the P/E ratio is that if it is above 20, the stock is currently overvalued and might not be the best choice for value investing.

What most value investors do is to look for those stocks, which have their P/E ratios at 15 or lower, in which case they are deemed to be undervalued. Finally, if the price-to-earnings ratio of the stock is between 15 to 20 range, then it is generally regarded as fairly valued.

Now, there can be many reasons for the stock trading lower than its fair value. For example, the firm might be facing a bad quarter, a change of leadership, a recession, or some other financial headwind. So, the core of the value investing strategy is to identify those undervalued stocks, buy them at a discount, and then benefit from the capital appreciation as the shares return close to their fair value.

Here it is important to mention that the market participants using this strategy, still have to conduct proper due diligence of the company. The fact that the individual stock currently trades below its fair value and has a low price-to-earnings ratio does not necessarily mean that its price will definitely rise in the future.

After all, there might be a good reason why the company shares are so cheap. There can be the case that the firm has lost most of its profitability or the organization is run by incompetent management. In those cases, even at those undervalued levels, the stock price might keep sliding, resulting in losses for the investor.

Therefore, it is essential for value investors to pick the stocks of those companies, which still have the potential to grow their earnings and maintain their profitability.

Growth Investing Strategy

Despite all of its uses, the value investing strategy is not the only method for stock trading. Another of the popular ways of trading stock is the growth-investing strategy. Now, the main similarity between growth and value investing is that both of them focus on capital appreciation of the investment.

However, the main difference between them is that growth investing does not focus on undervalued stocks. Instead, this strategy focuses on those companies, which have the potential to achieve a high growth rate for their earnings. Investors, using those strategies will also take a look at the past performance of the stock price. What they are usually looking for here is a stock, which is in a long-term upward trend. So, the main logic behind this is that if the individual stock has delivered a significant amount of capital appreciation to investors, it is likely to do so in the future as well.

Yet, it is important to point out that the past stock price history is not the only indicator that growth investors take into account. Another important indicator is the average and current growth rate of earnings-per-share indicator. The reality of the matter is that if a firm is growing its profits at a high rate, then it is likely that the stock price will rise as well.

Finally, many growth investors are also looking for stocks of companies that buy back their own shares on a regular basis. This is because the share buybacks tend to reduce the overall number of outstanding shares. As a result, the holdings of each shareholder of the company represent a slightly larger share of the firm.

The result of this process is that the earnings-per-share growth rate might be higher than that of the company profits. It goes without saying that in most cases the share buyback programs have a positive long-term effect on the share price.

Here it is also worth noting that growth investors are not always limiting their investments solely to stocks with price-to-earnings ratio of 20 or lower. Unlike with value investors, the market participants who focus on growth might still buy those stocks, which can be slightly overpriced on a P/E basis.

The reasoning behind this approach is the assumption that if the company is successful, raises its earnings, and buys back its shares on a regular basis, it's likely that the stock price will still maintain its long-term uptrend, regardless of its current slight overvaluation.

Here it is worth noting that this reasoning has its limits. Obviously, there is a considerable difference between those companies, which have their P/E ratios at 21, at a slightly overpriced level and the one which has its price to earnings ratio at 100. In the latter case, many experienced investors might consider the stock to be extremely overvalued. So here it is worth remembering that, even growth investors might decide to stay away from a stock if it has reached an extremely overpriced level.

Investing for Income

Another one of the most popular ways of investing is to build an income portfolio. This method of investing is especially popular with people who are looking for early retirement.

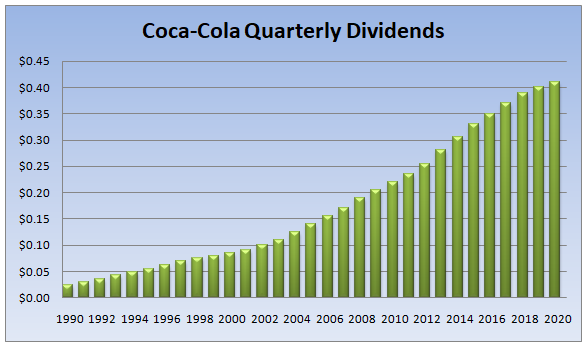

Income investing involves buying those stocks, which have a decent record of returning money to shareholders. In order to illustrate one example of this, let us take a look at this chart, which shows the dividend payment history of Coca-Cola Company (KO):

As we can see from the above image, back in 1990, adjusting for the stock splits, the Coca-Cola Company has paid a 2.5 cents per share quarterly dividend to shareholders. The firm has raised its payouts to shareholders consistently over the subsequent years. In fact, the company has even managed to increase its dividend even during the 2008 financial crisis.

By 2020, the quarterly dividend of the Coca-Cola company has reached 41 cents per share. This means that the average dividend growth rate for the last 35 years is well above 9%. Now, the long-term average US inflation rate stands at 3%. Therefore, this means that the Coca-Cola Company has increased its payouts three times higher than the inflation rate, which is quite impressive.

It goes without saying that when a company has such a solid track record of returning money to shareholders it is highly unlikely for the management to spoil such an impressive run for no good reason. Such a record shows that returning money to shareholders has been one of the priorities of the firm’s management over several decades.

Now, here it is important to mention that the dividend history is not the only factor income investors look at when making investing decisions. Another important indicator here is the current dividend yield. The dividend yield is measured by dividing the total annual dividend amount on the current share price.

Returning to our previous example, as of September 2020, the Coca-Cola Company stock trades near $50 level. The annual dividend payment of the company is 4 x 0.41 per share, which equals $1.64. The current dividend yield of the stock is $1.64/$50, which equals 3.28%. Now, this can be an attractive rate of return for many investors, since it is higher than the average inflation rate. Here it is also worth noting that if the firm keeps increasing payouts over the years, then the effective dividend yield will become higher as well.

On the other hand, If the stock has a very low current dividend yield, for example, 1% or lower, then it might be a good addition to the income portfolio. This is because even at today’s low interest rates, it is possible to earn those types of returns with savings accounts and certificates of deposit, without taking on any risk on the invested principal.

So, the obvious question here is: why would someone risk the principal of the investment in the stock market when an investor can get the same return with bank deposits? Therefore, many income investors do not invest in those stocks which have very low dividend yields.

The third important indicator the income investors look at is the so-called payout ratio. This indicator measures the percentage of the company’s earnings that the firm pays out to its shareholders. The general rule here is that if the payout ratio is higher than 80%, then the dividend payments might be unsustainable. The reason for this is that in this case, the firm’s management has very little margin of safety if the company’s profits decline, or if the corporation faces any other financial headwinds.

In fact, in some cases, we can see some cases where the payout ratio is higher than 100%. This means that the company pays out more money to shareholders than it earns on an annual basis. This suggests that some of those dividends are funded by the company’s cash reserves or by borrowing, which is not a very sustainable long-term strategy.

This is exactly why income investors are looking for those stocks, the payout ratio of which is lower than 80%. In fact, the lower the ratio, the more attractive the stock becomes. For example, if the payout ratio of the stock is 50%, then this might suggest that the current dividend payments be quite safe. This is because in this case, the company has a sizable margin of error if the firm faces some financial headwinds.

Now, the general strategy with this approach is to create a diversified portfolio of dividend-paying stock and grow it by regular investing. In this way, investors can grow their income consistently, until they reach the point where they will be able to cover all of their living expenses. At this point, they can retire early with help of those income streams.

By Konstantin Rabin of BuyShares.co.uk - an online portal about stock trading.