On Friday we saw traders head for the exits as it appears nobody wanted to be invested over the weekend going into the election, states TG Watkins of Simpler Trading.

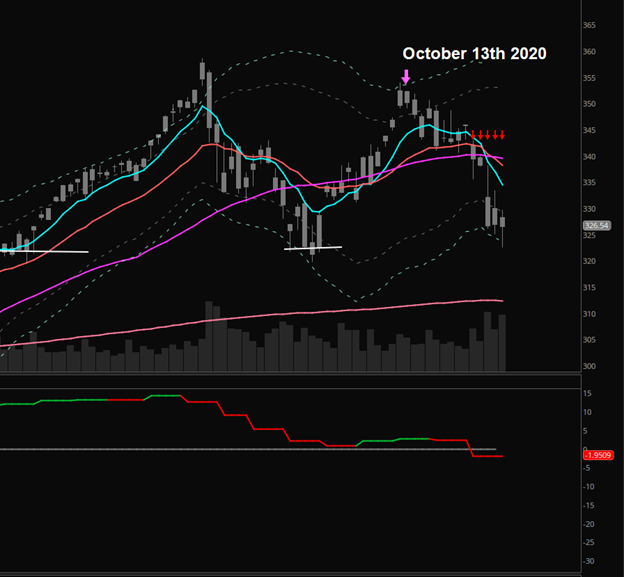

We saw the market top on October 13, but I was looking to see how well price might hold up as it was coming into support of a big prior price area. That view went out the window once the SPY price got rejected by the underside of the hourly 50 SMA. That rejection was the start, or actually the second half, of the pre-election decline.

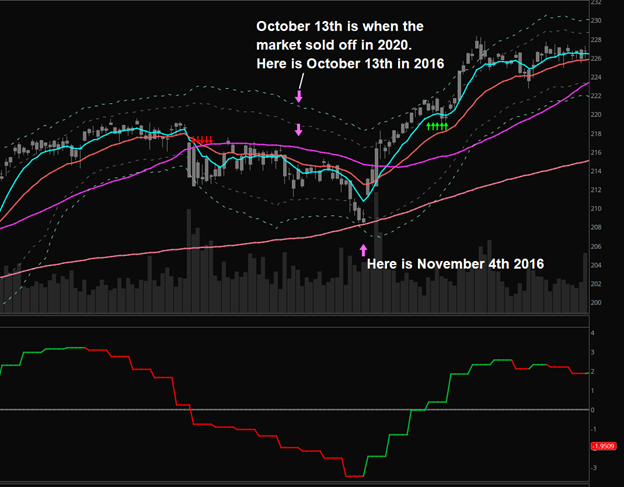

I went back to see how the market behaved in 2016 going into the election and while the idea of people exiting to let the storm pass by, the action wasn’t as brutal to the downside. The initial break to the downside started on September 9, and it was pretty much a sideways, hold your breath, type of movement until price started to waterfall the week before.

As it turns out, the SPDR S&P 500 (SPY) bounced off the hourly 200 SMA, which is reasonable, but we would never know the counter if the election results were different.

This year was vastly different with a big run up, which culminated in a double top on the 13th. I was viewing it as a pullback in an uptrend until the downside got confirmed by price running into the underside of the hourly 50 SMA. Since then, the downside has been steep and swift with traders not willing to put money to work in the market.

Anything goes at this point. So much is different this year, and I wouldn’t be surprised if we don’t have a clear answer about the election results by the night of the 3rd. So, I am mostly in cash, sitting on the side lines, ready to watch the show.

TG Watkins is the director of stocks at Simpler Trading.