The other week I wrote Not My Trade, which detailed how there can be moves in the market, but because they don’t set up the way I want, I skip them. This can be difficult because we feel like we are missing out, but if you trade long enough you realize there is always another opportunity, states TG Watkins of Simpler Trading.

Then another couple of weeks earlier I wrote Tis Not the Season, which spoke about how sometimes the environment just isn’t conducive for trading.

Well, I believe the market has moved on from there. That the season is upon us and it is now my kind of trade setting up with the market. It took some time and lots of patience, but with the election getting further in the rearview mirror (though not official yet) and the market getting vaccine news, there are now reasons for the market to get on track again.

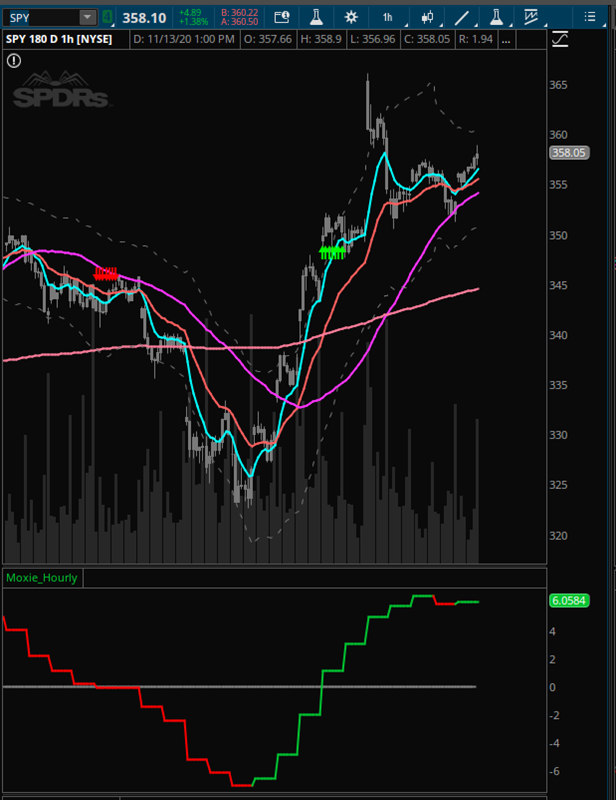

As for the vaccine news, the market responded well to it. At least in the names that need it the most. The corresponding gap up was far too big to do anything with, so that is where the patience came in, having to wait for price to pull back or flag to support. If you look at the SPDR S&P 500 (SPY) below, you will see that the hourly chart has double-bottomed and bounced off the hourly 50 SMA. The hourly 50 SMA was the primary moving average I was looking for price to find support at.

As we were waiting for the market to pull back, there were many names setting up beautifully and others taking off with strength as they saw this as a simple pullback in a new uptrend. It has been a solid week for us, and I foresee this week being fantastic as well. Part of why I say this is that I checked the futures Sunday evening, and they are up, which makes it difficult for me to have much concern about lack of strength. The move I have directed into appears to be working out like a charm and should give us a strong wind at our backs.

TG Watkins is the director of stocks at Simpler Trading.