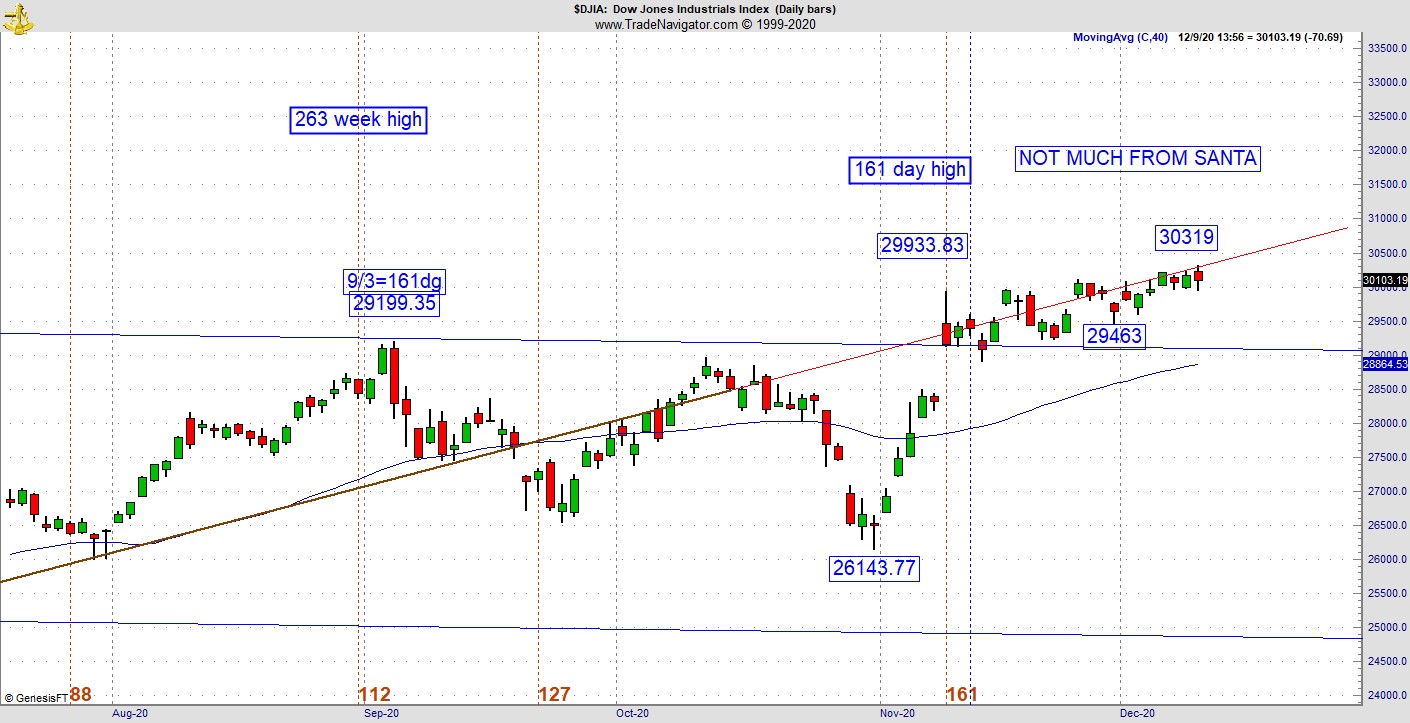

The Dow has stuck to the magnet line going back to June while it has gained 856 points since the Monday after Thanksgiving and not counting the losses on Wednesday. The big story on Wednesday was tech, which put in a major red candle, explains Jeff Greenblatt of Lucas Wave International.

We haven’t talked about longer-term cycles in an exceptionally long time. Okay, right now the markets sitting near all-time highs are 615 weeks off the 2009 bottom. The 610-week window was a low or secondary low in October. The end of the year is going to be the golden spiral 618 weeks off the 2009 bottom. That’s potentially not good news given everything going on this month with the electors put to bed the first week of January.

We could be hitting a long-term top based on the cycle points and if the geopolitical situation wants to go sideways, the stock market won’t get in the way. In other words, with conditions being ripe, the Fed would no longer be able to kick the can down the road if it came down to it. This isn’t a prediction, markets don’t have to top at 618 weeks, but it could and many times it does.

That might sober up some of us. Right now, at 615 weeks, it is possible tech could put in the high right here with this big red candle. There have been other years where the market put in a high in December but didn’t start dropping until January. Perhaps they won’t even need a geopolitical problem, it will be enough of a catastrophe to look at the holiday sales with Christmas on lockdown this year.

I don’t need to tell anyone time is nearly up when it comes to this election as the Supreme Court will hear the lawsuit filed by the state of Texas. The lawsuit alleges Georgia, Michigan, Pennsylvania, and Wisconsin conducted their elections in ways that violated the US Constitution and several sources have reported eight other states are joining this lawsuit, and by late Wednesday CNBC reported that number has swelled to 17 states.

This mess is not close to being over. The mainstream media reported on Tuesday SCOTUS denied a request filed by Sen. Mike Kelly (R-Penn) for emergency injunction relief. Some thought this was the end of the trail for Trump. Not so fast, the supremes were looking for a more meaningful case. This is the case that could flip the election, or they could send it back to the state legislatures to decide their own electors.

What about China? On December 1, attorney for Trump Lin Wood revealed China bought Dominion Voting Systems for $400 million. The payer was UBS Securities and it happened on October 8, just weeks before the election. According to tokenist.com the payer of the funds was UBS Securities LLC, which is a subsidiary of Swiss investment bank UBS. The funds were paid to Staple Street Capital, which bought Dominion in 2018. Let’s be clear, the payer was UBS Securities based in Beijing, not New York. The broker for this deal was Chinese vice premier Wang Qishan who is a finance specialist for the Chinese government. Finally, the day before Lin Wood made all this public, 12 of 15 UBS board members resigned. If it can be proven in court the Chinese are behind this attempt to overthrow the US election process, its possible we could be setting up for a war with China.

This is an incredible time to be alive and we could have a front row seat to history in the coming days and weeks. How do you protect yourself against the potential for historic volatility? No matter what time frame you trade, you must understand your edge. You must know when you have a greater probability of a trade working in your favor. Each week I come here with a Kairos price and time example. I know that when price and timeline are up, odds go way up my trade will work. They don’t all work as there are stop outs on a regular basis. But those losses must be small.

Do you know when you have the edge? Let’s just say you’ve never heard of Kairos and you use a moving-average method. I’ve had students who’ve come to me and they would go long if the price action went above a certain moving average and short when the action went below. I don’t advocate that type of system but in case you do use a system like that realize the weak points and flaws in such a method. Moving-average systems won’t work well in consolidating or sideways markets. The point here is no matter what your methodology is, understand the types of markets where it works well and not so well. Finally, if you are in a trade and you no longer understand what your edge is, you are gambling. I’ve run into many traders who were lucky as opposed to being skillful. For instance, during the Internet bubble days it has been said 90% of the market participants lost 90% of their capital.

It’s more important to lose on a trade where you know what your edge was and why you entered as opposed to winning on a questionable setup. Say that again! Some people believe in the Vince Lombardi theory that winning is the only thing. Not when it comes to trading. Why? If you win today on a questionable setup, you may end up taking the very same setup tomorrow or next week and get crushed. It's okay to get lucky but it's better to be lucky when you are good as opposed to cashing in on something that has no better than a 50-50 chance of working out. Does that make sense?

At this point, events that will develop are beyond the job description of the average Joe to predict. It will impact financial markets. Take it slow through this period and be cognizant of the bigger cycle point coming due at the end of the year.

For more information about Jeff Greenblatt, visit Lucaswaveinternational.com.