Wednesday was a Fed announcement day three days prior to the Gann reset. Nothing has been decided yet in the stock market, explains Jeff Greenblatt of Lucas Wave International.

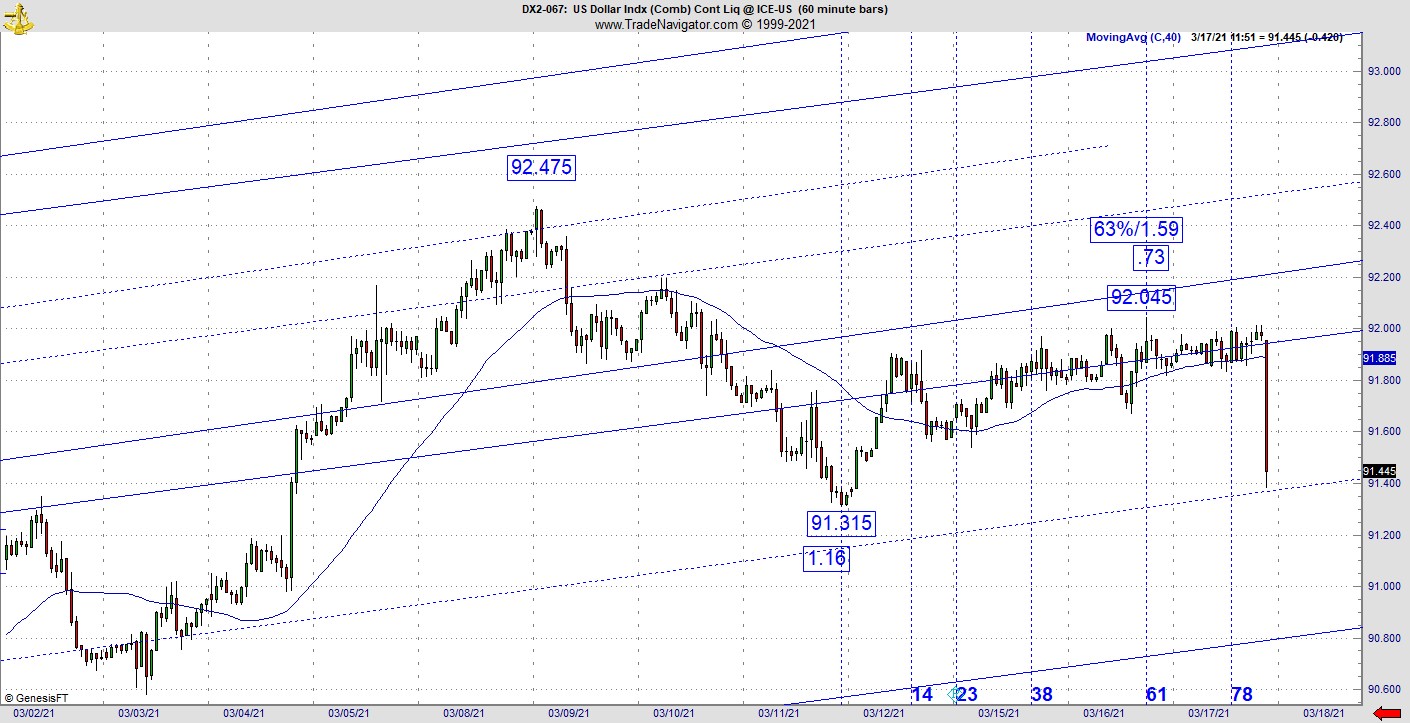

We were watching the greenback last week, which was at a crossroads as it receded from the channel line. But it only dropped for three red candles before deciding to retest the high. Then it got slammed on the Fed event.

A quick look at the chart shows a retracement slash line at 63% and 1.59, which is awfully close to golden spiral levels as the bounce also stalled at 61 hours up. So, we had the cherry Kairos vibration before the news event. From the daily view we now see price action pulling away from the channel line after a retest. Americans love their stimulus checks, which they deserve but they are ruining the value of the currency with all the helicopter money.

The ten year, which was below its 144-day pivot is still questionable as it tries to find that elusive low.

If you back up about three weeks, several days after the high, we were looking at the NDX gap down as a possible secondary high before the more aggressively bearish scenario, which would’ve given us a chance to refill the gap on the way down. Now it looks like the NDX wants to fill that gap on the way up. Still hanging out there on this chart is the 261-day window, which isn’t until Easter weekend.

Markets have followed the stimulus psychology. They knew it was coming and tens of millions of Americans received their $1400 right on St. Patty’s Day. If we are in a buy-the-rumor and sell-the-news sequence, the market could top in the next few days at the Gann reset seasonal change point coming up by Monday. This has been one of the more interesting yet complex cycle windows I’ve seen in several years. This season has more scenarios than usual. It appears midstream and still has more work to do. All I can tell you is if we get to early April and no correction has started, we may be in one of the biggest bubbles of all time. Looking at this from 30,000 feet taking the economy into consideration, this has to be the biggest bubble of all time.

It doesn’t feel like it, does it? After all, our generation has lived through two bubbles already. I don’t think we’ll ever be able to party like its 1999 anymore. That being said, lots of folks partied long and hard buying houses they couldn’t afford between 2005 and 2008. Now we sit at all time highs with the much of the world still on lockdown. Let’s face it, if the Fed didn’t back up all this stimulus over the past year, the Dow might be sitting at 10,000 right now.

Even Powell stated the economy is dependent on what happens with the virus. He went on to say wearing masks and social distancing will help the economy recover. I didn’t realize he would give so much material for the late-night comedians. First, as you’ve seen, he didn’t fool greenback traders who all but destroyed this countertrend bounce on the news. Odds greatly increase this could already be the Gann reset high on this chart.

This is a financial column, and it has been my view the virus did not wreck economy, it was terrible political policy to shut down the whole world, which destroyed it for a whole generation. As long as there is social distancing, there can be no recovery. Let’s be clear, the only way the economy ever recovers for real is if they open every state and let business run to capacity. Texas is about to try it, yet there is lots of resistance to the idea.

Are we at all-time highs? That means stocks are priced to perfection. I remember a time if a company didn’t have blow out earnings, they’d take it straight to the woodshed. That dynamic changes when there is so much money printing.

Are businesses in a perfect environment? Not when they only allow 1800 fans into Madison Square Garden for a hockey game, which seats 18,200. See, when a father wants to take his son to MSG and pays $200 for two tickets and $500 for two rapid Covid tests, something is wrong, and I don’t need the Fed chairman to tell me that. You can look at your own community and come up with a number of reasons as to why the economy won’t recover anytime soon.

There is still a glut of oil yet prices at the pump have skyrocketed lately. I thought prices only go through the roof when demand goes way up. Those who still have jobs and no longer commute due to working out of the home has also cooled demand. As the price of oil has doubled since November, something is wrong with this picture.

Let’s put a seal on this. I’m still looking for the Nasdaq-100 (NDX) to fill that overhead gap. Its so close the gap is likely acting as a magnet point to the price action.

What happens there in the very least will determine if the patterns survive into the 261-day window of this rally the beginning of April. In my view, the only reason the market is elevated is due to stimulus, not economic growth. Powell told us he doesn’t see rates climbing for the foreseeable future. He’s right about that. Remember the last time they tried to raise rates moderately in 2018? The US dollar could very well already be at the early stages of the next bear leg down. Do your best not to view this time as business as usual. Be careful to watch out for these cyclical pitfalls from here to the beginning of April.

Fore more information about Jeff Greenblatt, visit Lucaswaveinternational.com.