Investors and traders are constantly looking for the “next big thing” in the hope of getting in early and riding the bullish trend to the top, pocketing huge gains along the way, explains Ian Murphy of MurphyTrading.com.

Unfortunately, this search for hidden gems often takes us into nooks and crannies of the market where risky assets dwell, and sad stories of loss are sure to follow. However, the best trades are often languishing in plain sight, carry extremely low risk, and are so obvious they are almost a cliché.

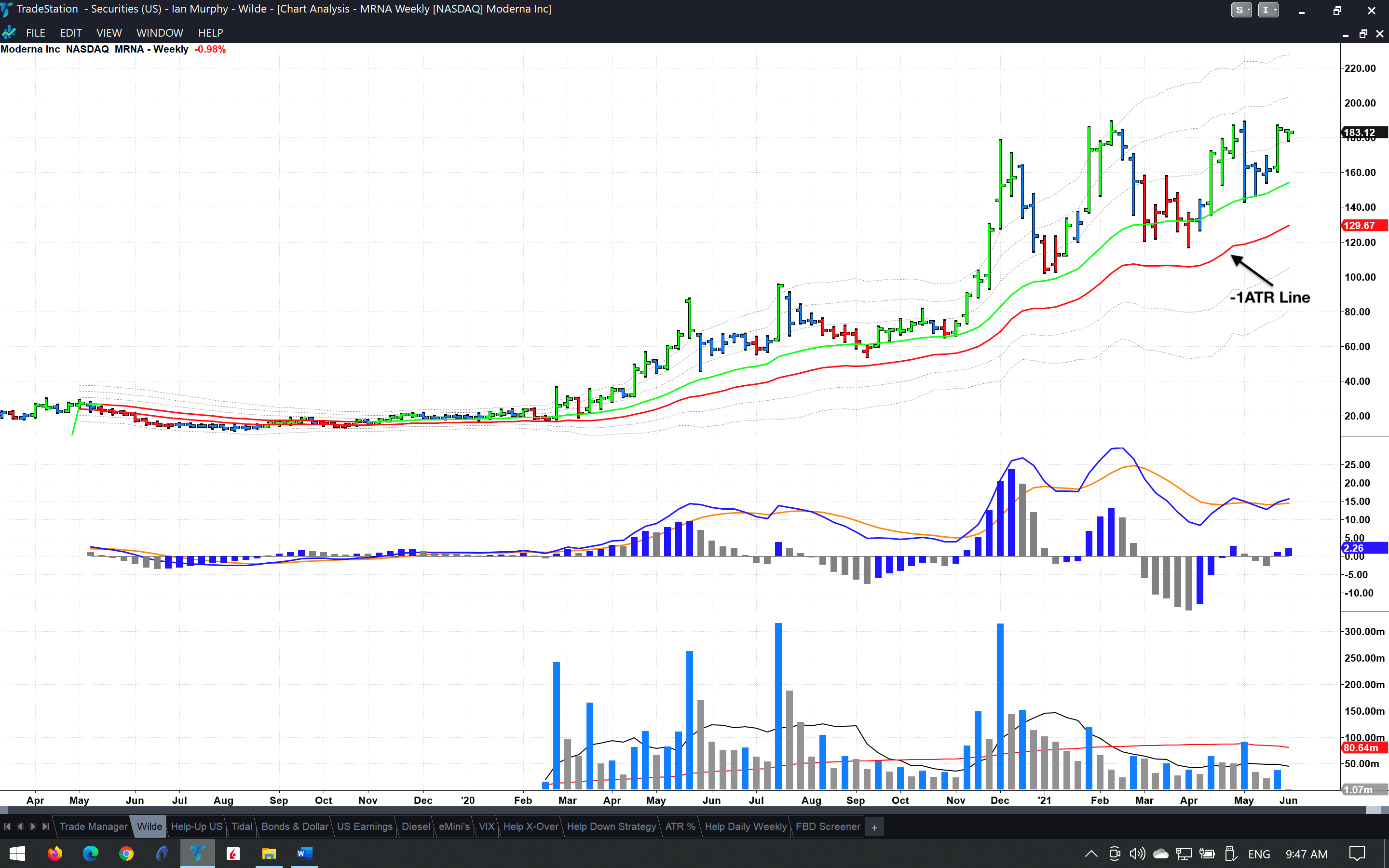

Moderna (MRNA) burst onto the scene last year when Covid went global. Trading under the cleverly named ticker ‘MRNA’, the firm produces messenger RNA vaccines, which are beginning to look like a silver bullet for the pandemic. Over 15 months the price has climbed steadily upwards but pulled back strongly on three occasions. A trailing stop set on the -1ATR channel (red line) of a weekly chart locked in steady profits while allowing sufficient breathing space for the pullbacks, one of which saw an almost 40% reduction in capital.

In hindsight this trade appears to be so obvious it’s hard to believe it could be that simple to make money—a global pandemic, a small firm with new technology, efficacy rates above 90%, and governments falling over themselves to place orders. And yet, this stock has increased over 800% since March 2020.

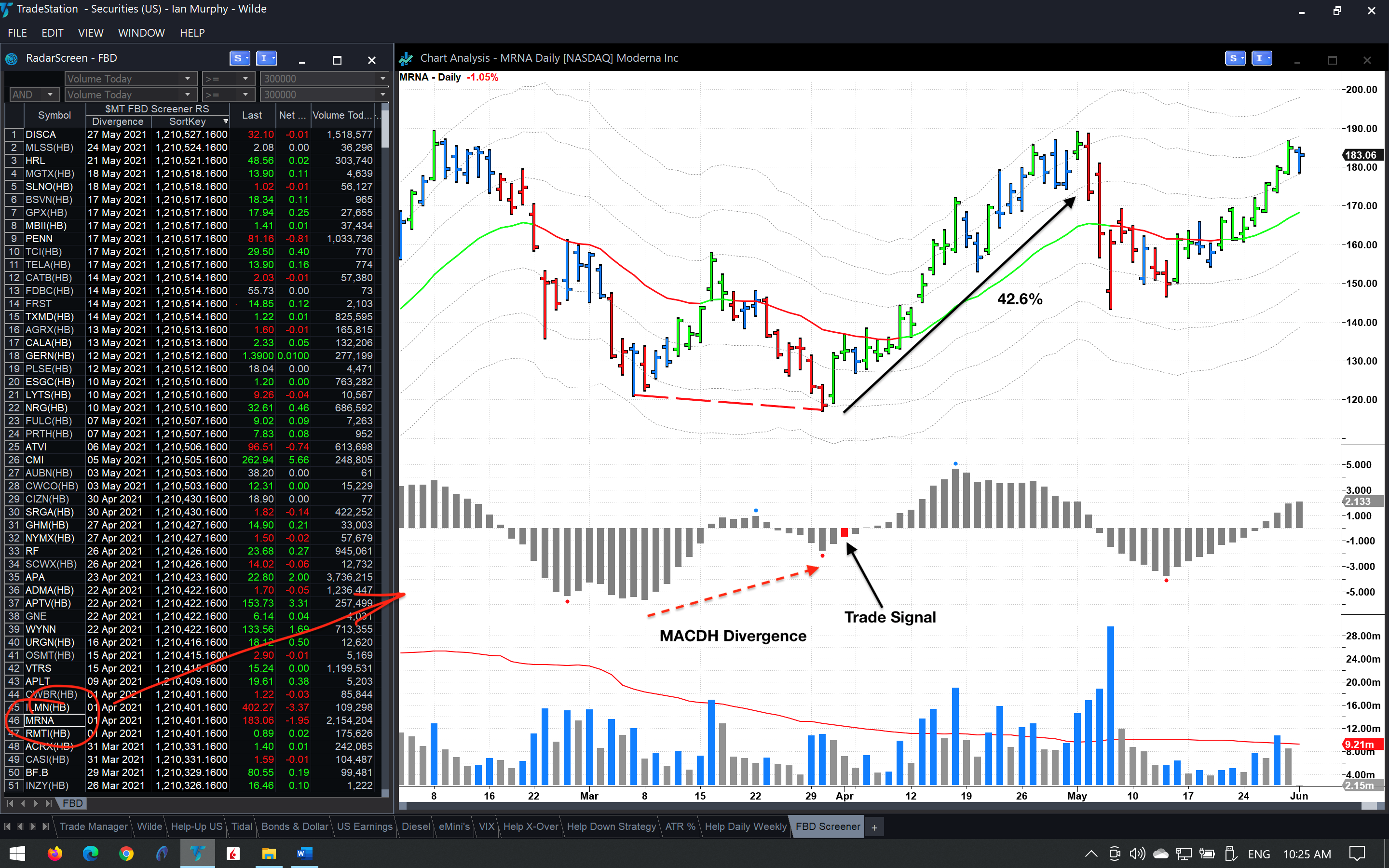

The stock also provides excellent swing trading opportunities, and so it was at the beginning of April when Moderna gave a classic daily swing trade for the False Breakout strategy (more about this new strategy below). The price gained 42.6% from the entry signal on April 1, 2021, before pulling back sharply and stopping out the trade.

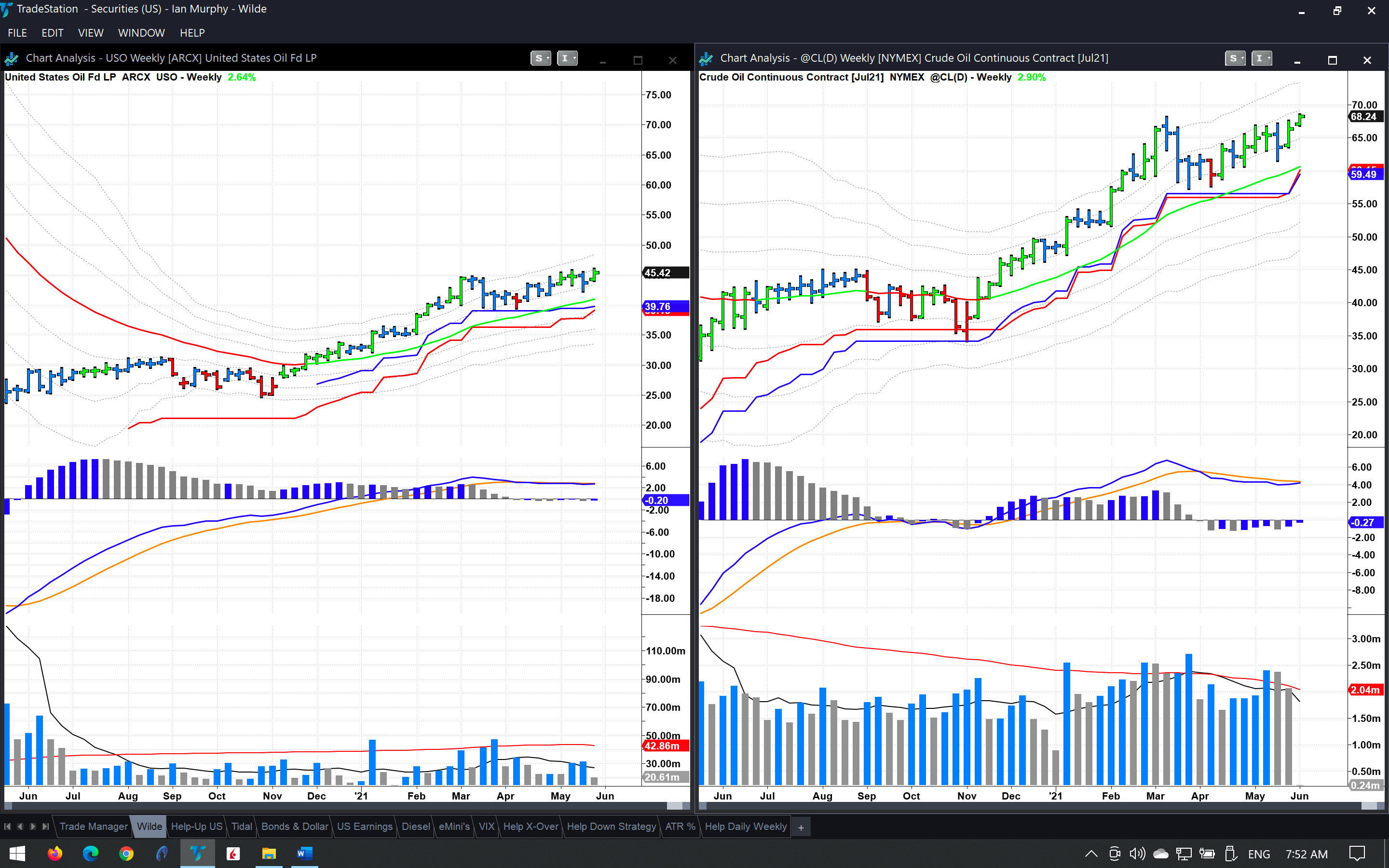

Oil is another perfect example. When prices were in the gutter last winter commentators concluded the black stuff was an asset in terminal decline. The popular United States Oil ETF (USO) dropped to $24.75 in November but has proven the commentators wrong with a gain of 83.5%. Futures fared even better; the price has doubled.

Tighter trailing stops would be more appropriate on oil due to geopolitical exposure. ATR based stops set to monthly and quarterly look-back periods performed admirably and neither has been breached.

MoneyMasters Class

We are finalizing details for a free two-hour class at the MoneyShow® Virtual Expo on July 13-15. Called Practical Tools for Profitable Trading, the class will be broken into four 30-minute sessions where I will share some of the powerful techniques, I use daily to leverage market opportunities in a way which is especially useful for retail and part-time traders.

The fourth session will review recent trades based on the material covered in the class and focus on stocks which are currently setting up as likely trading candidates.

Full details with a registration link will be sent out closer to the event. Mark your calendar!

Learn more about Ian Murphy at MurphyTrading.com.