A funny thing happened on the way to our carbon-based-energy-free future. This...explains Mike Larson, editor of Safe Money Report.

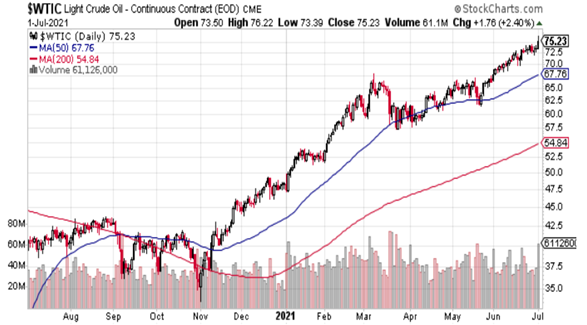

This a one-year chart of US crude oil futures. You can see that prices have more than doubled off their November 2020 lows, recently topping $75 a barrel. Not only was that the highest price since October 2018, it’s within a whisker of the highest since late 2014!

And the rip-roaring rally isn’t contained to crude. Natural gas prices have also surged more than 150% from their lows last summer.

As for retail gasoline? If you traveled by car for the Fourth of July holiday weekend, you know it’s going up, up, up! Gas prices have climbed roughly $1 in the past year to $3.13, according to AAA.

Naturally, those gains are lighting a fire under oil and gas stocks. The Energy Select Sector SPDR Fund (XLE) has surged 35% so far in 2021—more than TRIPLING the 11% gain of the SPDR S&P 500 ETF (SPY). Or in plain English, a sector that was once left for dead...is now rising FROM the dead!

What’s behind the gains? Good old supply and demand!

Demand has come roaring back thanks to the economic recovery, the resurgence in travel, and heavy government stimulus spending. Producers also cut output during the worst of the COVID-19 pandemic, leaving supplies tighter than they otherwise would’ve been.

Major producing nations are trying to play catch up. In fact, the countries in the OPEC cartel and Russia spent last week negotiating an increase in output last week. That would ease the cuts implemented last year, which amounted to around six million barrels per day.

But any rebalancing process will take time...and that means higher prices are likely here to stay for a while. So, if you’re looking for new places to put your investment dollars, energy is worth a look again.

Safe Money Report focuses on these kinds of stocks, which include names in the consumer staples, food and beverage, retail, and healthcare sectors. Visit Safe Money Report here.