Earlier this year, surges in GameStop (GME), Blackberry (BB), and AMC Entertainment Holdings (AMC) were prompted by retail traders rallying on Reddit to coordinate purchasing of stocks with significant short interest, in turn, inducing short squeezes, states Garrett DeSimone of OptionMetrics.

Traders with short positions in GME were subject to margin calls and forced to buy back their stock in GME, as a result, perpetuating upward price spirals. In conjunction with short squeezes, GME became virtually impossible-to-borrow (ITB) with a rate upwards of 50% in February, as just one example.

Borrow rate, or the privilege of borrowing shares, is not free. It involves borrowing a stock that an investor does not own and paying a fee, or borrow rate, which is expressed as an annual percentage. For liquid securities, these fees are low, averaging about 0.25%. However, stocks with significant short interest can become hard-to-borrow (HTB), or nearly ITB, with rates exceeding 25% for some annually. Implied borrow costs reflect the market makers’ costs of shorting in the options market.

Looking at the borrow rate, or the costs of shorting stocks across various horizons and maturities, can give institutional investors and academia the ability to pinpoint short-selling pressure, analyze dynamic borrowing conditions, and improve research on short-selling positions.

So, where is GME today after its momentous monstrous squeeze earlier this year?

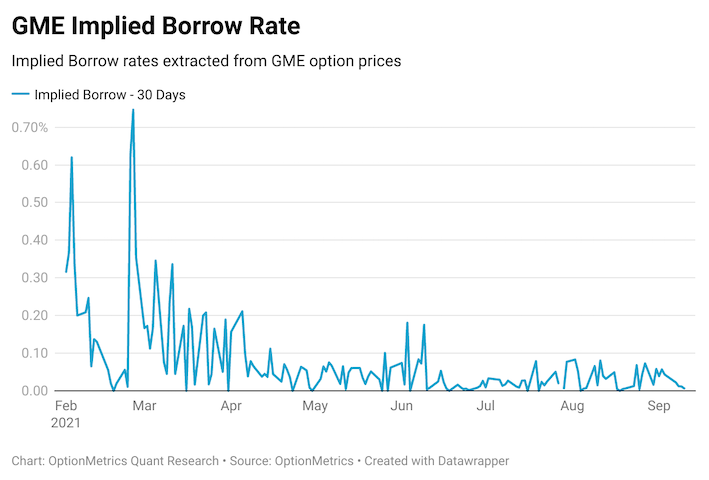

The table below plots the standardized 30-day borrow rate. Shorting costs for GME have come back down to earth with rates consistently less than 1%. As a result, the price of shorting GameStop has never been cheaper and is comparable to borrow rates for highly liquid, mega cap names.

This indicates that market in GME has become much more liquid, and a trader can buy or sell the stock with relative ease. This is likely due to a reduction in the total short interest on GME from levels of 42% in early 2021 to 10% in September 2021.

Additionally, we see market makers have been able to analyze retail behavior more effectively, and therefore accommodate their order flow in the options market.

While GME could rally in the future, it likely will not be a result of the short squeeze, given the changes in the dynamics of the market.

Where might the next short squeeze come from? While GME is not what it used to be when it comes to the short squeeze, other stocks with high short interest might be future targets for them.

Borrow rate is an important measure that can be used to help to assess stocks that might be susceptible to short squeezes.

Garrett DeSimone, PhD, is Head of Quantitative Research at OptionMetrics, LLC. His company is an options database and analytics provider for institutional and retail investors and academic researchers that has covered every US strike and expiration option on over 10,000 underlying stocks and indices since 1996.