Something’s got to give in the markets. And it may not take long before the next long-term trend becomes apparent, says Joe Duarte of In the Money Options.

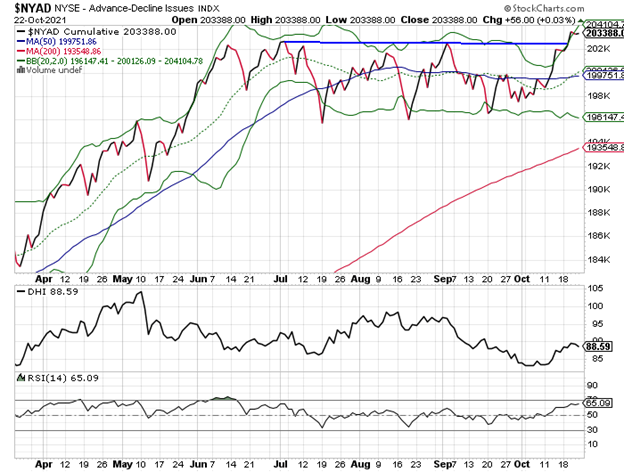

The most reliable market indicator since 2016, the New York Stock Exchange Advance Decline line (NYAD), see below for full details, exploded to a new all-time high last week, and did not fall apart by week’s end. This is signaling that for now, against all odds, despite the Fed’s confirmation that the QE tapering is coming, the uptrend for stocks is back.

More interesting, as I will detail below, is the fact that even though stocks have broken out, options players remain very skeptical of the gains and bond traders are expecting the Fed’s actions to slow the economy.

MELA Test Straight Ahead

The likelihood of a major move in the MELA system, where the markets (M), the economy (E), people’s life decisions (L), and the algos interact (A), is approaching.

I know this sounds a bit confusing. But here’s what seems to be happening. As I’ve noted here before, the bond market is torn between the sellers, who are afraid of inflation, and the buyers, who are betting that when the Fed tapers the economy will tumble.

Lately, the sellers have been in control of the bond market, as evidenced by the rising yield on the US Ten Year note (TNX). This rise in market interest rates has put a damper on the stock market, which in true MELA fashion, has put a bit of crimp on the economy, especially areas such as home buying, as people have become cautious and slowed down their purchases. All of which has been amplified by the algos and created a choppy trading range for stocks.

Until Friday, that is, when Fed Chairman Powell noted that it was “time to taper,” and TNX rolled over after running into intermediate-term resistance near the 1.7% yield area as the buyers came in.

So now we have an interesting setup. With less than a week before November, the month in which the Fed has signaled it will start its taper, bond traders are betting that the Fed’s actions will hurt the economy while stock traders are betting that the bull trend in stocks has returned.

How Is This Possible?

Remember that the stock market is the centerpiece of MELA since it is the source of wealth for a large number of people via their 401 (k) plans and other stock-trading related venues. In other words when the 401 (k) does well, as in periods when stocks rise, people feel wealthy and buy things.

And what do stocks like best? They love lower interest rates. All of which means that if the Fed tapers and things slow down, stock traders are betting that the Fed will likely have to restart QE.

In other words, it’s all about the Fed and how the bond and stock markets respond because it will all play out in MELA.

It’s time to buckle up.

Why Astra Zeneca’s Monoclonal Covid Antibody Gamble May Pay Off

Shares of pharmaceutical giant Astra Zeneca (AZN) have been under quiet accumulation of late and recently scored a price breakout.

The breakout is interesting for sure, mostly because AZN’s Covid vaccine has been associated with rare, but serious, complications. At the same time, other Covid vaccines have also been associated with complications. All of which means that even though the vaccines have been useful against the pandemic, there is clearly a treatment niche that needs filling in the fight against the virus.

Certainly, AZN has a top-notch research team, which is why it’s no surprise that they have developed a new and very promising monoclonal antibody to treat Covid infections, which may fill that niche. Of course, at first glance they seem to be getting to the party a bit late given that Eli Lilly (LLY) and Regeneron (REGN) already have very successful Covid antibodies on the market.

But here is what could be the game changer; AZN’s antibody may be useful as a preventive treatment for Covid, meaning that it is a potential vaccine-like product, although not likely a replacement. At least that’s what the studies suggest, and what the company is trying to convince the FDA and global health agency approval committees of.

Put another way, AZN may be an alternative or an adjunct to Covid vaccines, which would not likely replace vaccines but would give physicians another treatment option based on well-accepted clinical situations such as patients at high risk of vaccine reactions. In addition, the AZN antibody can be administered on an outpatient basis, reducing costs and keeping hospital beds open for emergencies.

Moreover, the stock is also attractive based on the fact that AZN has several blockbuster drugs that have been flying under the radar of late such as its diabetes treatment Forxiga and several key anti-cancer drugs, which are fueling year over year sales gains above 30% and an earnings growth rate of 20%.

Technically, AZN has cleared long-term resistance above $61, where it may consolidate in the short term as traders wait for approval news on the antibody. But the stock is in an excellent setup for sure as accumulation distribution (ADI) has flattened out, which suggests that short sellers are exhausted while 0n-balance volume (OBV) has been moving higher, confirming that buyers have been using recent price dips to move into the stock.

I own shares in AZN as of this writing.

Options Traders Just Don’t Trust this Market

In what may be a bullish contrarian sign, put volume continues to outshine call volume at key strike prices on the SPY options. What’s most interesting is that even as the market’s breadth (see below) has improved, option traders remain skittish and continue to buy puts just below the most current market price.

Of course, the precise nature of this development suggests that algos are hedging their bets. And while market maker algos hedge their bets based on order flow, CTA algos (quant funds) make bets on technical-analysis-based support and resistance levels.

It’s not clear whether what we’re seeing is the market makers or the CTAs. If it’s the CTAs, the odds may favor a rally if the market breakout continues as they will have to cover their shorts further. If the market maker algos are hedging, though, it could mean that the order flows are bearish and that this rally could be short lived.

Market Breadth Finally Breaks Out

After a nearly five-month trading range the stock market’s breadth finally broke out with the New York Stock Advance Decline line (NYAD) moving above recent and multiple-times-tested resistance level. Thus, until proven otherwise the uptrend has been re-established.

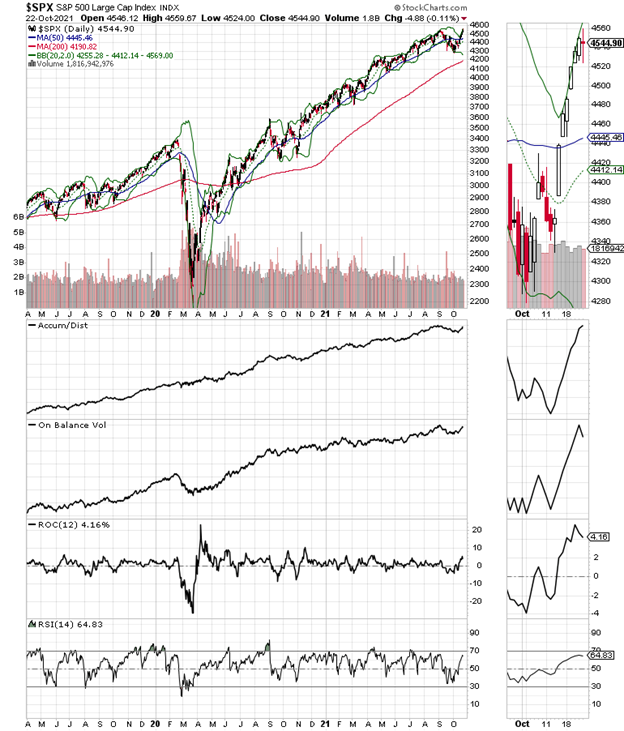

The S&P 500 (SPX) is hovering near its all-time highs and trading above 4500 as well as its 20,50, 100, and 200-day moving averages with good confirmation from accumulation distribution (ADI) and on-balance volume (OBV).

The Nasdaq 100 index (NDX) did not fare as well as SPX as it did not deliver an all-time high and ended last week on a much-weaker note.

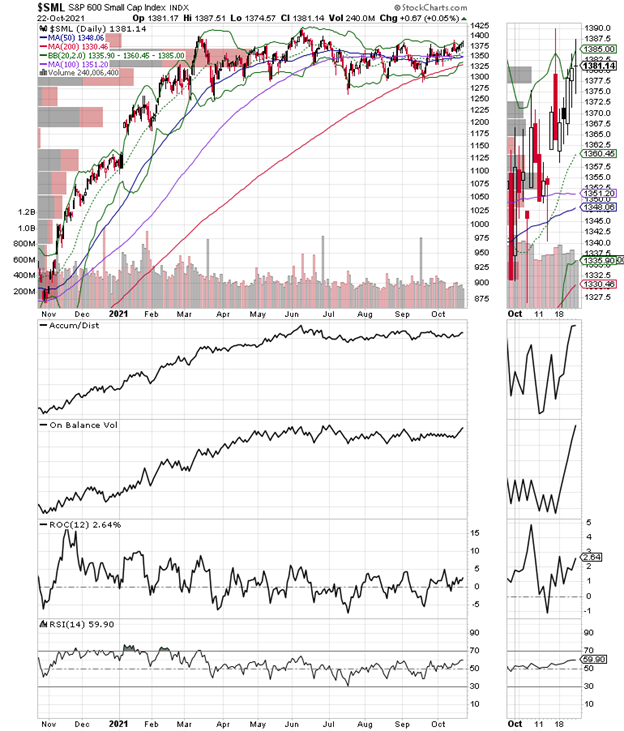

Meanwhile the S&P Small Cap 600 index (SML) is knocking on the door of a potential breakout, but still remains somewhat further away from its all-time highs than NDX and SPX.

To learn more about Joe Duarte, please visit JoeDuarteintheMoneyOptions.com.