The broad market made new lows for 2022 a week ago, says Lawrence McMillan of Option Strategist.

That reaffirms the pattern of lower highs and lower lows on the S&P 500 (SPX) chart, meaning that the bear market is still intact.

There should be some support at last week's lows, near 3650. Beyond that, one has to go to a longer-term chart to find support: 3500 and then 3200. However, this week, $SPX has mostly been attempting to rally.

There were massively oversold conditions, so an oversold rally is likely beginning.

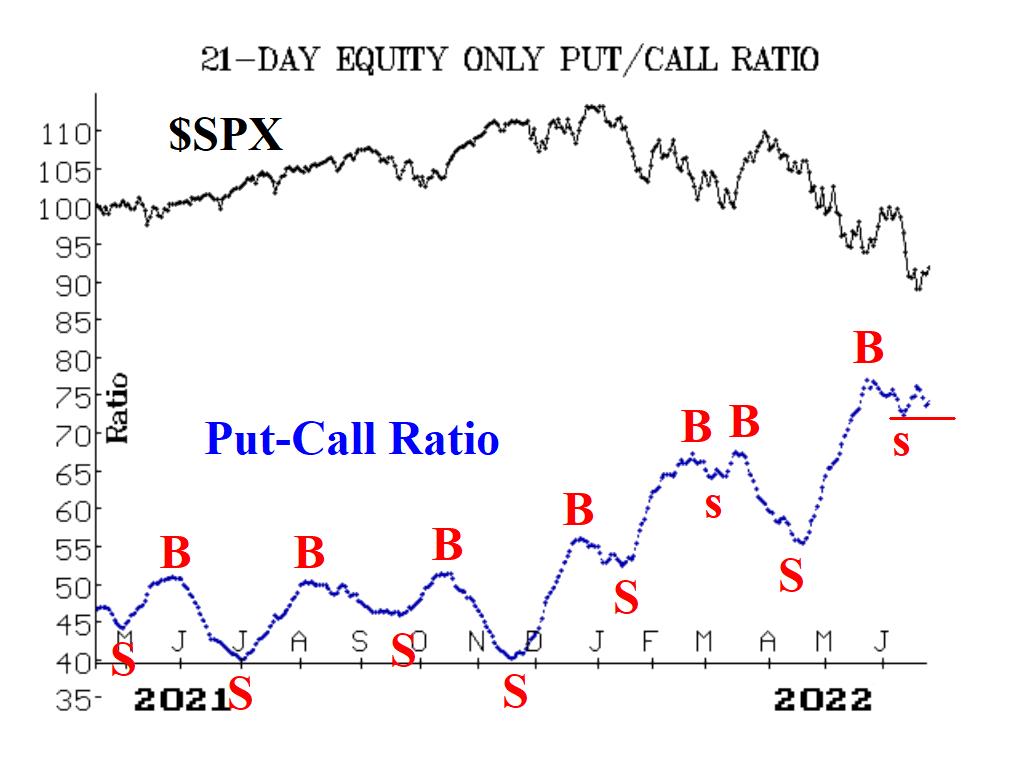

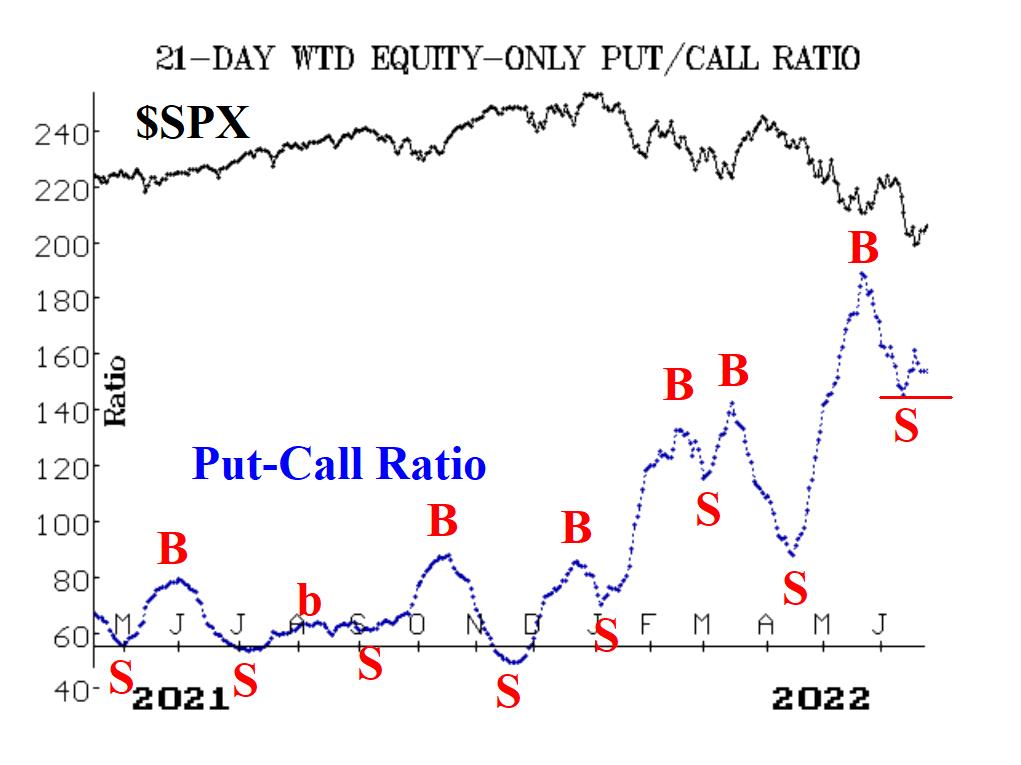

Our target for the next oversold rally is 4017—a slight overshoot of the declining 20-day moving average which closes the gaps on the $SPX chart. Equity-only put-call ratios have been meandering sideways for the last few days.

In my opinion, they need to make new relative lows—below the lows of early June—in order to solidly move back to buy signals. Market breadth has improved greatly this week. The breadth oscillators were so oversold, though, that this improvement has still not generated confirmed buy signals. Those buy signals, however, are right on the brink of occurring, and would be confirmed if breadth is positive today (June 24).

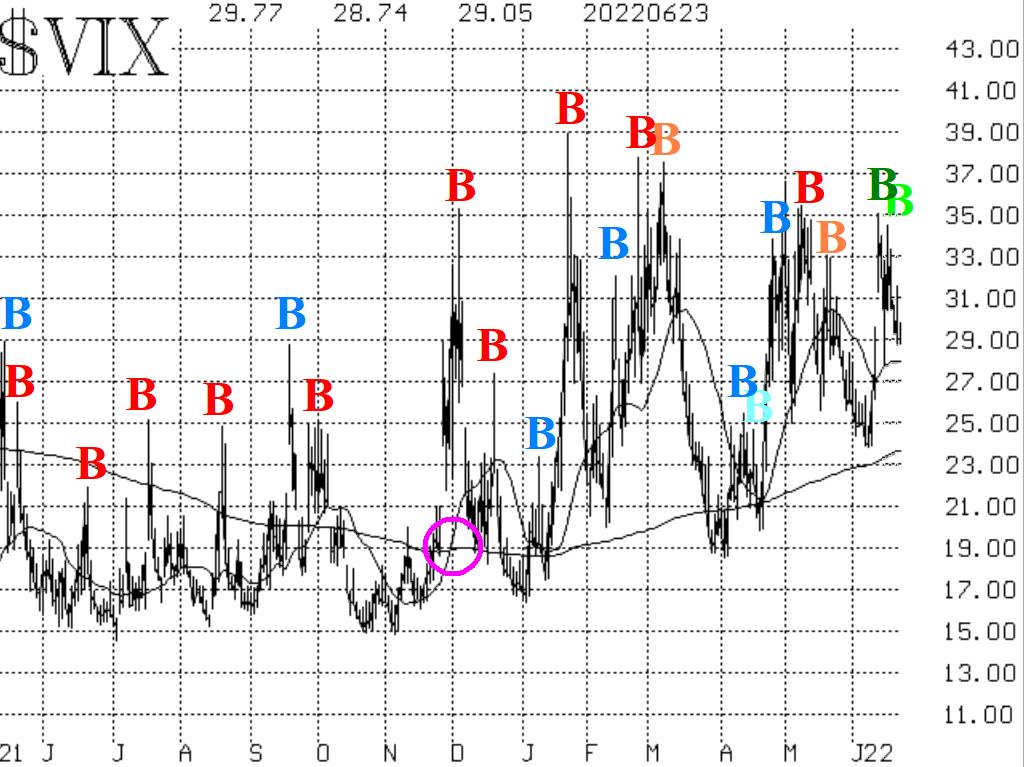

The COBE Volatility Index (VIX) has drifted lower this week, after having generated a "spike peak" buy signal on June 15 and then confirming it with another, overlapping buy signal on June 17.

So that is another confirmed buy signal that is in place. Conversely, the trend of $VIX remains upward, which is negative for stocks. This negative intermediate-term signal would cease if $VIX were to close below 24. In summary, the "core" bearish position is still in place, but we are prepared to trade confirmed buy signals around that. Those buy signals are beginning to appear, so the next oversold rally is likely underway.