This cycle, we have already seen an inordinate amount of outright fraud that has proven to be a terrific indicator of where we stand in the larger market cycle, states Jesse Felder of TheFelderReport.com.

Today, Bloomberg reports that earnings quality for the S&P 500 (SPX) recently fell to its worst levels in at least three decades and this may be an important sign of where we stand in the larger economic cycle.

The way they quantify “earnings quality” is to compare the aggregate net income of all companies in the index (ex-financials and energy) to aggregate cash flow. Normally, cash flow should be greater than earnings because it adds back non-cash charges like depreciation and amortization. When that is not the case it can be a red flag that companies are resorting to accounting gimmicks to make earnings look better than they otherwise would. By inference then, companies haven’t employed “financial shenanigans” (to borrow a term from CFRA Founder Howard Schilit) to inflate earnings as aggressively as they are doing today at any point in the past few decades.

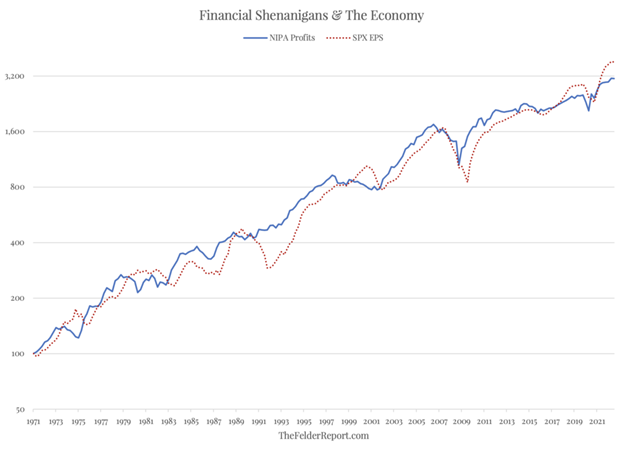

Another way to approach this issue is to compare S&P 500 Index earnings to NIPA profits (tracked by the BEA). These two figures are plotted in the chart above. As Gavekal founder Charles Gave recently pointed out (hat tip, David Hay), “When S&P 500 profits diverge dramatically from NIPA profits, it is a sure sign that accounting methods have changed at S&P 500 companies. If S&P 500 profits rise to exceed NIPA profits by 20% or more, it is a signal that companies’ reported profits are being generated largely by their accountants.”

Moreover, there are important economic implications for all of this. Gave continues, “Usually this means that the economy is on the brink of a recession and that the stock market is about to take a beating.” Last year, we crossed that 20% threshold between S&P 500 earnings and NIPA profits. Perhaps we should add this to the growing list of leading indicators pointing to recession.

Learn more about Jesse Felder at TheFelderReport.com.