Despite the stock market rally so far in 2023, the S&P 500 Index has not come close to regaining its all-time high put in early last year, states Jesse Felder of TheFelderReport.com.

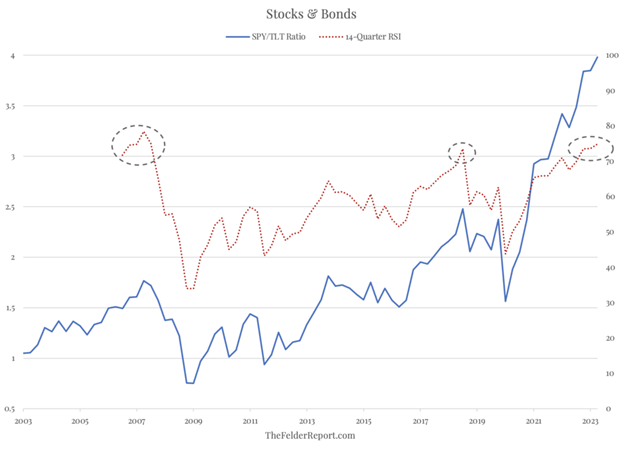

What has soared to new highs, however, is the stock/bond ratio. In fact, its ascent has been so strong that, over the past two decades, the SPY-to-TLT ratio has only been as overbought (as measured by quarterly RSI) as it is today at the 2007 top heading into the GFC. It came close back in late 2018, just before the steep fourth-quarter selloff that year, but didn’t quite manage to reach the level we see currently.

Learn more about Jesse Felder at TheFelderReport.com.