There is an assumption among market participants that US budget negotiations and the related debt ceiling deadline will be resolved at the last minute, states Ian Murphy of MurphyTrading.com.

As the clock ticks down some are wondering if playing chicken for such high stakes might lead to an accidental default, and stocks are weaker as a result.

Source: stockcharts.com

On the issue of government IOUs, the yield curve on US treasuries (left) has become so inverted it now resembles a ski slope. This reliable predictor of past recessions will only start to level out when rates are cut and there is no sign of the Fed doing that any time soon. Against this backdrop, moving out of equities and into cash for the summer is looking attractive for many.

Source: stockcharts.com

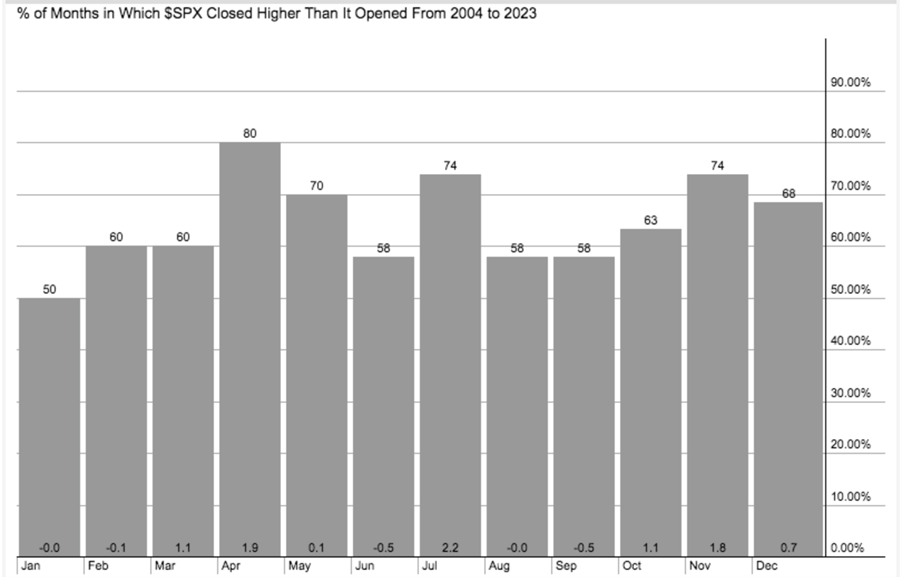

Traditionally, the volume of activity on stock exchanges dries up for the parched summer months as people used to, ‘Sell in May and go away’. But that is less true these days. Looking at how the S&P 500 (SPX) closed compared to how it opened on a monthly basis for the past 20 years, June, August and September are only marginally lower than February and March, but the summer months still performed better than January.

Learn more about Ian Murphy at MurphyTrading.com.