In this article, we will analyze a series of covered call trades shared with me by a BCI premium member, states Alan Ellman of The Blue Collar Investor.

These trade executions involve establishing a bullish covered call position, then rolling down, and then rolling out. All of our trades serve as learning opportunities and these Elevance Health, Inc. (ELV) trades are no exceptions.

ELV trades from 11/7/2022 to 12/1/2022

- 11/7/2022: Buy 200 x ELV at $532.09

- 11/7/2022: Sell 2 x 12/16/2022 $530.00 calls at $26.50 (bullish near-the-money strike)

- 11/11/2022: ELV trading near $490.00

- 11/11/2022: BTC 2 x 12/16/2022 $530.00 calls at $4.30

- 11/17/2022: ELV declines to $477.00

- 11/17/2022: STO 2 x 12/16/2022 $490.00 calls at $9.12 (rolling-down)

- 12/1/2022: ELV trading at $529.50 (missed a “hitting a double” opportunity)

- 12/1/2022: BTC 2 x 12/16/2022 $490.00 calls at $41.00

- 12/1/2022: STO 2 x 12/30/2022 $530.00 calls at $10.40 (rolling out for a net debit of $30.60)

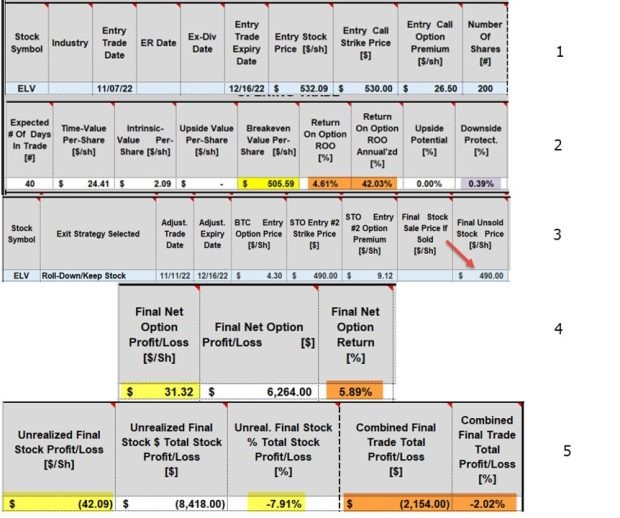

BCI Trade Management Calculator Showing Initial Trade Structuring and Rolling-Down Adjustments

ELV: Initial Calculations and Rolling-Down Exit Strategy

- #1: Initial trade entries

- #2: Initial returns (4.61%; 42.03% annualized based on a 40-day trade). The downside protection of 0.39% is negligible as we are using a near-the-money strike

- #3: Rolling-down trade entries (shares cannot be worth more than the new rolled-down $490.00 strike)

- #4: Final post adjustment option return after rolling down: 5.89%

- #5: Post adjustment unrealized stock loss (-7.91%) and net stock and option unrealized loss (-2.02%)

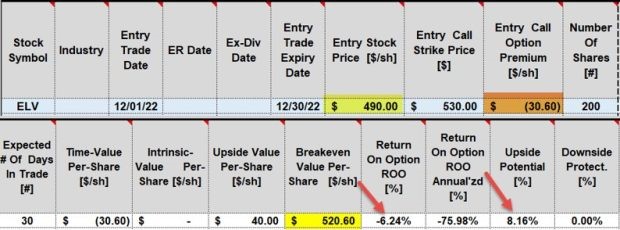

BCI Trade Management Calculator Showing Rolling-Out Initial Trade Status

ELV: Rolling-Out Calculations

Note the following:

- The value of the shares at the time of the roll was $490.00, the previous contract strike or our obligation to sell at that price

- The BTC-STO net premium was -$30.60 (-6.24%)

- The success of this trade depends on upside potential (8.16%) if the share price moves up to or beyond the $530.00 strike

Discussion and lessons learned

- The BTC on 11/11 was excellent (near our 20% guideline)

- The BCI guideline is that prior to the last two weeks of a monthly contract after a breach of the 20%/10% guidelines, we seek to “hit a double” if the share price recovers (may have worked out in this case). If not, we roll down in the last two weeks of that contract

- By rolling down on 11/17, a share loss of $42.09 was locked in ($532.09–$490.00)

- On 12/1, $41.00 was paid to make shares worth $39.50 more ($529.50–$490.00). It is possible, another $0.50 could be gained, if the share price moves up to or beyond the $530.00 strike but no more due to the contractual obligation to sell at $530.00

- Whether the share price moves to $532.00 or $535.00 or $1000.00, shares can only be worth $530.00, the new strike

Over the past 25 years, I have made every mistake in the books and learned from them. This process has allowed me to develop the skillsets I wish for all our members.

Learn more about Alan Ellman on the Blue Collar Investor Website.