Which percent, if any, of our original covered call writing initial time-value return, asks Alan Ellman of The Blue Collar Investor.

Should we use it to close both legs of the trade, and guarantee a realized return? 60%? 75%? Higher? Lower? Closing both legs of a covered call writing trade mid-contract is known as the mid-contract unwind (MCU) exit strategy, in our BCI methodology.

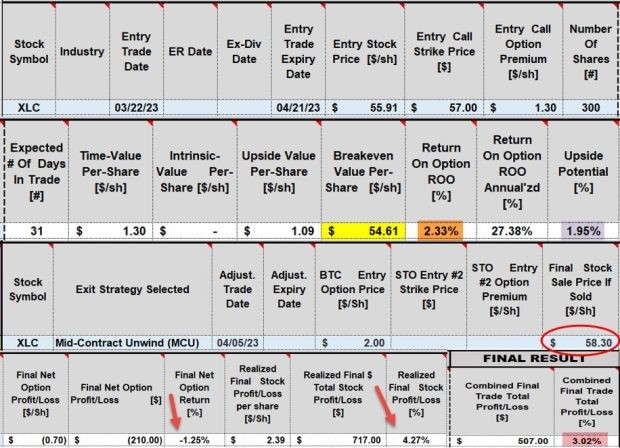

On April 5, 2023, Brad shared with me a series of trades he executed with Communication Services Select Sector SPDR Fund (XLC) when using BCI’s CEO Strategy.

Brad’s Trades with XLC

- 3/21/2023: Buy 300 x XLC at $55.91

- 3/21/2023: STO 3 x 4/21/2023 $57.00 calls at $1.30

- 4/5/2023: BTC 3 x 4/21/2023 $57.00 calls at $2.00

- 4/5/2023: Sell 300 shares of XLC at $58.30

Questions from Brad

- How to calculate final returns?

- Did implementing the MCU make sense?

BCI Trade Management Calculator: Entries, Adjustments, Initial and Final Calculations

XLC: Initial and Final Calculations

Note the following results with the Trade Management Calculator:

- Yellow cell: Breakeven price point

- Brown cell: Initial 31-day time-value return

- Purple cell: Upside potential if XLC moves up to, or beyond the $57.00 strike price

- Red oval area: Final security sale price

- Red arrows: Final % option loss & final % stock gain

- Pink cell: Final realized net % gain

Time-Value Cost-to-Close

The trade was initially structured with a 2.33% initial time-value return and a potential additional 1.95% from share appreciation for a max return of 4.28%. The final realized return after implementing the MCU exit strategy was 3.02%, resulting in a time-value cost-to-close (CTC) of 1.26%.

BCI Guidelines on When to Implement MCU

We ask ourselves if we can generate at least 1% more than the time-value CTC, 1.26% + 1% = 2.26% or more by contract expiration. If yes, then MCU is appropriate. If not, we continue to monitor the trade.

***Note: We can also use the Unwind Now worksheet tab at the bottom of the TMC spreadsheets to calculate time-value cost-to-close.

Learn more about Alan Ellman on the Blue Collar Investor Website.