Growth stocks are making new highs daily. You need to prepare for extreme overbought conditions next. But my message is simple: Not only are new all-time highs coming for markets regardless, the evidence points to a sustained rally ahead, writes Lucas Downey, co-founder at MoneyFlows.

Let’s rewind the tape. One month ago, I warned you that forced buying is coming. Extreme capitulation prefaces breath-taking rallies.

Back then, I made the case that today’s environment mimics the Covid-19 crash and the late-2018 crash. Both gave birth to monstrous inflection points. I’m taking that bullish playbook a step further today.

The #1 power law of investing is supply and demand. It’s that simple. When supply falls and demand increases…markets explode higher. And it’s happening faster and faster these days given the rapid rise of automated trading.

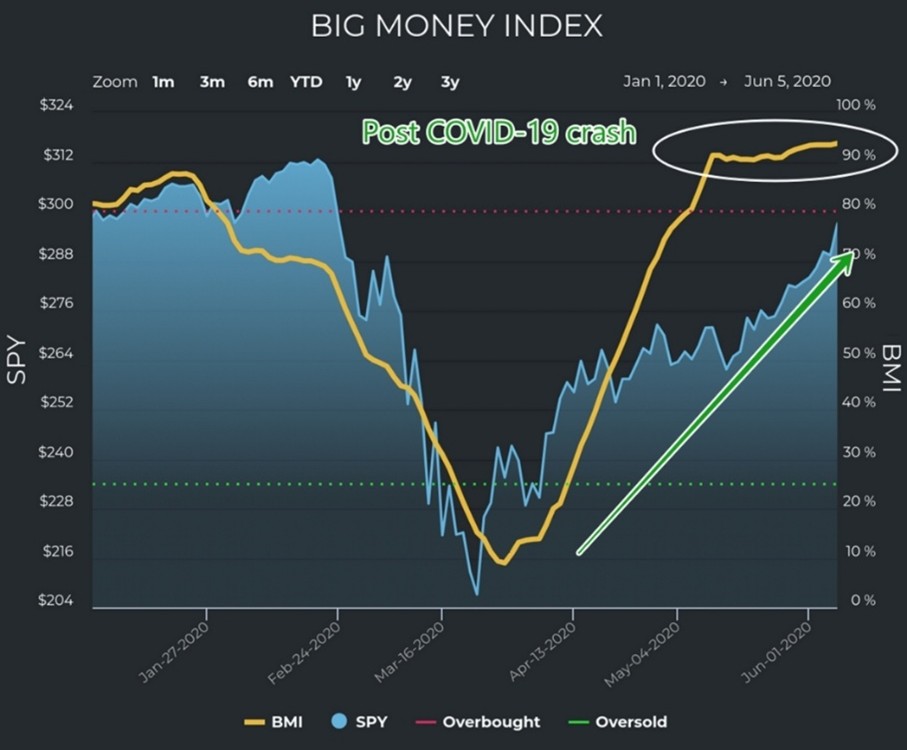

Here’s our Big Money Index (BMI) which tracks real-time demand for thousands of equities, paired with the SPDR S&P 500 ETF (SPY). From the April lows, our data has signaled UPSIDE:

That red zone horizontal line is a reading of 80%. That’s the official overbought zone. On the surface, it may appear that reaching the red zone is a great time to take profits. However, given the extreme capitulation we witnessed in April, there’s a high likelihood that we’ll hang in the red zone for a prolonged period.

Social media had a field day comparing 2025’s selloff to the GFC crash of 2008. Even worse was the comparison to 1929. But again, the better analogs for today’s environment are much more recent: The Covid-19 crash and recovery and the late-2018 crash and recovery.

Both periods saw wicked prolonged periods in the overbought zone. Here’s the Covid-19 BMI analog. Notice how the steep BMI from the lows pierced the red zone and flatlined there for weeks.

That’s what I suspect is coming to a market near you. That repeatable pattern can be seen today. Violent capitulation ignites forced buying which we are seeing the beginnings of now.