Most know us as market breadth experts. What you may not realize is we score thousands of stocks and ETFs every single day. Our number one “Outlier” stock in 2025 is Agnico Eagle Mines Ltd. (AEM). This under-the-radar gold exploration company has seen earnings explode, observes Lucas Downey, co-founder at MoneyFlows.

We use a 29-factor model that ranks every company based on fundamentals like earnings growth expectations, sales estimates, and other forward-looking data points. The technical factors incorporate momentum and obviously the quality of money flow signals. Here’s why it’s powerful.

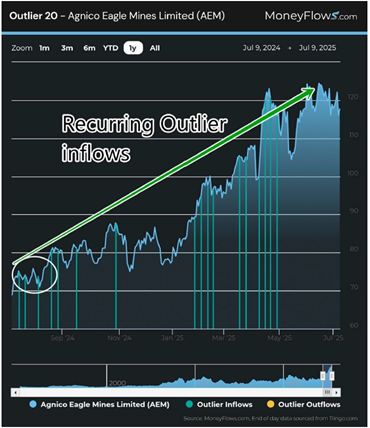

When you sift through hundreds of stocks each week under accumulation, and sort stocks from highest score to lowest score, you find outliers. Our Outlier 20 report isolates the 20 highest ranked inflows each week. This is the report that found Nvidia Corp. (NVDA) in 2015 and Super Micro Computer Inc. (SMCI) in 2022.

Sitting on institutional trading desks taught us to respect money flows…especially with all-star stocks. In 2023, AEM net income stood at $1.94 billion. Estimates peg that number to soar to $3.33 billion in FY 2025.

With expected earnings growth of this magnitude, it should come as no surprise that institutions were all over this company over the past 12 months. Again, our process is built to find tomorrow’s winners early. The chart here reveals each time AEM made our Outlier 20 report…that’s the stairway to heaven!

Understanding the money flows picture is paramount. That’s the market North Star. Now that the second half of 2025 is here, this is one of the best environments for picking stocks that are NOT on the lips of the media.