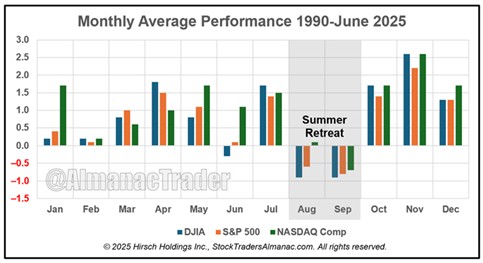

Over the last 35 years, August and September have been the worst-performing months of the year. Average performance has been mixed in August with the Dow Jones Industrial Average and the S&P 500 Index (^SPX) recording losses of 0.9% and 0.6%, respectively, while the Nasdaq Composite Index has eked out a meager 0.1% gain, notes Jeff Hirsch, editor-in-chief of The Stock Trader’s Almanac.

September has been red across the board for the Dow, S&P 500, and Nasdaq. Here’s a recap of where things stand heading into this seasonally weak period.

(Editor’s Note: Jeff will be speaking at the 2025 MoneyShow/TradersEXPO Orlando, scheduled for Oct. 16-18. Click HERE to register.)

Seasonal: Bearish. August is the worst month for the Dow and Russell 2000 Index and second-worst for the S&P 500, Nasdaq, and Russell 1000 Index over the last 37 years (1988-2024), with average performance ranging from +0.1% by Nasdaq to a -0.8% loss by the Dow. In post-election years, Augusts’ rankings are little changed, but performance has been negative.

Fundamental: Mixed. The ultimate impact of tariffs on inflation is still unclear. But most recent inflation metrics have ticked higher and are still above the Fed’s stated 2% target. Second-quarter GDP is expected to rebound after a negative Q1.

Technical: Breaking Out. The S&P 500 and Nasdaq have logged multiple new all-time highs, while the Dow has not. But technical indicators are getting stretched and the market could be due for a period of consolidation or a modest pullback.

Monetary: 4.25% – 4.5%. The Federal Reserve meets this week and is widely expected to announce no change to its key rate on Wednesday. Political pressure is mounting alongside calls to investigate the Fed’s $2.5 billion renovation project at its headquarters in Washington.

Sentiment: Neutral. According to the Investor’s Intelligence Advisors Sentiment survey, Bullish advisors stand at 51.9%. Current readings suggest there is some upside potential remaining in the market. But it is likely to be far less than the magnitude of gains over the past month.