Valued at $1.4 trillion, Broadcom Inc. (AVGO) is a premier designer, developer, and global supplier of a broad range of semiconductor devices. Since the Trend Seeker tool signaled a buy on May 1, the stock has gained 54%, notes Jim Van Meerten, analyst at Barchart.

I identified AVGO by sorting for stocks with the highest technical buy signals, superior current momentum in both strength and direction, and the Trend Seeker signal. I then used Barchart’s Flipcharts feature to review the charts for consistent price appreciation. AVGO checks those boxes.

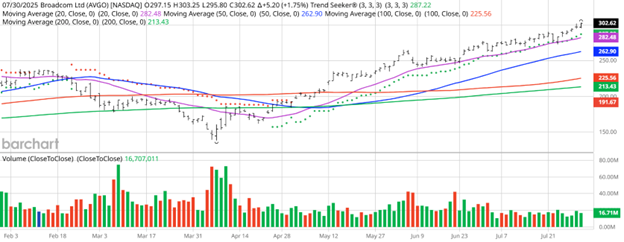

AVGO Price vs. Daily Moving Averages

What else do I like? Broadcom shares hit a new all-time high on July 31, touching $306.95. AVGO has a 100% technical “Buy” signal, a Weighted Alpha of +98.4, and it’s trading above its 20-, 50- and 100-day moving averages. The Relative Strength Index is at 71.5% and AVGO has technical support at $297.86.

Revenue is projected to grow 21.9% this year and another 20.5% next year. Earnings are estimated to increase 36.8% this year and an additional 23.6% next year. Plus, the Wall Street analysts tracked by Barchart have issued 33 “Strong Buy,” one “Moderate Buy,” and only three “Hold” opinions on the stock.

Bottom line: Broadcom currently has momentum and is hitting new highs. It has positive sentiment from Wall Street, plus analysts project double-digit increases in revenue and earnings.