Fewer companies are commanding a larger share of the market these days. The bears are terrified that high S&P 500 Index (^SPX) concentration makes an imminent market crash inevitable. But weak breadth is a great recipe for big market GAINS, says Alec Young, contributor at MoneyFlows.

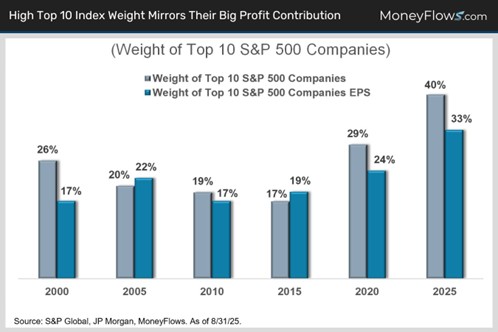

It’s true that the S&P 500 has become more top-heavy in 2025. The biggest 10 companies now comprise 40% of the index versus only 17% in 2015. That’s a sizable jump from just a decade ago.

But here’s why this new reality isn’t something to fret over. Ten stocks representing 40% of the index simply reflects their massive 32.5% share of S&P 500 earnings, up from only 17% in 2015. Note how earnings-heavy the top 10 is today versus 2000.

The second quarter was a case in point. The top ten stocks saw EPS grow 25% versus 8% for the rest of the S&P, per FactSet. By boosting overall index profit growth, rising index concentration has actually improved equity returns. It’s bullish...not bearish.

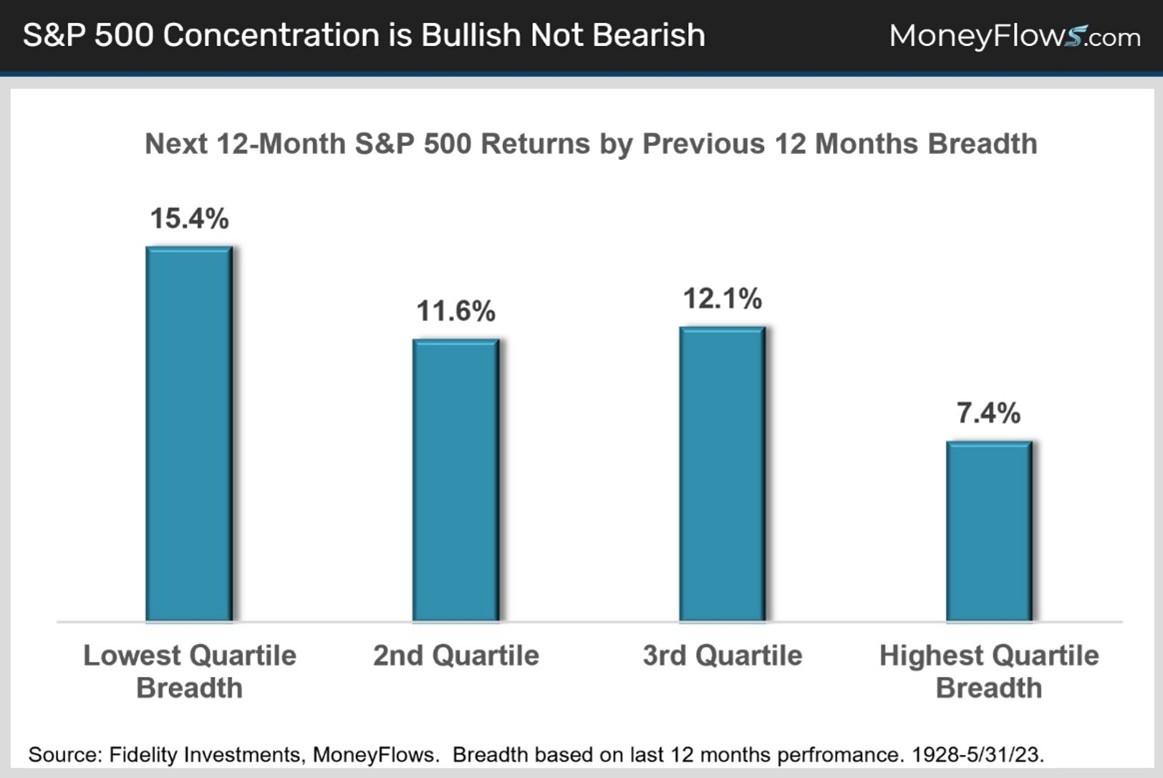

When we measure S&P 500 constituents that have outperformed the index on a 12-month basis, currently just 29.2% of stocks are beating the benchmark. Since 1928, weak breadth readings like this have forecasted 15.4% NTM average returns for the index.

On the flip side, when breadth is ultra-strong and plenty of stocks are outperforming, you can expect stocks to average just 7.4% gains 12 months later. In other words, weak breadth is a great recipe for big market gains.