Markets climbed above key moving averages on Monday, retesting the 50-DMA three times before pushing higher. The Invesco QQQ Trust (QQQ) hit new all-time highs as tech led the rally. But the Invesco S&P 500 Equal Weight ETF (RSP) lagged — showing how narrow the market’s leadership has become, writes Lance Roberts, editor of the Bull Bear Report.

The “buy the dip” mentality continues to dominate, delivering the best returns in 33 years. Meanwhile, the US dollar is trending higher, bond yields are sliding below 4%, and foreign investors are returning to US markets. With the MACD close to turning back to a “buy,” a new market high could confirm the bullish trend.

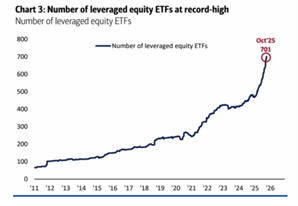

However, there are certainly reasons to remain concerned about risk. Wall Street is happy to produce products to meet investor demand, and with speculative risk soaring, it is not surprising to see more speculative products surge in quantity. But many of today’s popular products use options, which work great as long as the market is rising.

Yet these products can, and will, go to nearly “zero” during a market decline. Most retail investors piling into these securities do not fully comprehend the risk they are taking. Most notably, we are not talking about 2x or 3x leveraged products any longer. We are now seeing 5x leveraged products.