From dividends to pass-through entities and options overlays, there are practical ETF strategies for generating income – but trade-offs behind each approach. Traders should be cautious with options overlay ETFs, writes Tony Dong, lead ETF analyst at ETF Central.

Many investors, especially retirees, prefer seeing income deposited into their accounts. This explains why income-focused ETFs have exploded in popularity. There are many ways to categorize them, but I find it most useful to sort them by risk and trade-off.

Using options overlays, for instance, can unlock additional income potential by selling upside, typically through covered calls or cash-secured puts. The idea is straightforward. You earn immediate premium income by agreeing to limit your future gains. The balance between income and upside depends on three things: Time to expiry, how far the option is from the current price (moneyness), and, most importantly, how volatile the underlying asset is.

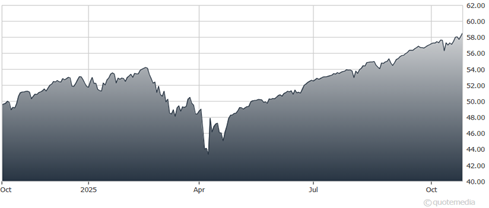

JPMorgan Nasdaq Equity Premium Income ETF (JEPQ)

A good example is the JPMorgan Equity Premium Income ETF (JEPI), which generates a 7.1% yield by selling out-of-the-money S&P 500 index calls through equity-linked notes (ELNs). Its sibling, the JPMorgan Nasdaq Equity Premium Income ETF (JEPQ), does the same for the more volatile Nasdaq-100 and recently yielded around 9.4%. Both use ELNs for capital efficiency, though that structure means distributions are generally taxed as ordinary income.

This corner of the ETF market has seen explosive growth. Beyond broad-market strategies, issuers are now rolling out single-stock and synthetic versions that use what’s called a “poor man’s covered call.” These combine long call and short puts at the same strike and expiry, with short call to mimic a covered call position without owning the stock outright.

Some advertise double- or even triple-digit yields, but traders should be cautious. Much of that payout is return of capital, and not the constructive kind. NAV erosion over time is a real risk.