Futures fell 1% yesterday morning, with the S&P 500 Index (^SPX) breaking 6,800. There is no one clear single trigger here, more just a loss of upside aspiration. Ultimately, we view any dip trade as an intraday swing until/unless SPX moves back above 6,900, writes Brent Kochuba, founder of SpotGamma.

The CBOE Volatility Index (^VIX) is sniffing 20, while SPX IV's generally were up a fairly mild one vol point. Key levels for the SPX are:

Resistance: 6,900, 7,000

Pivot: 6,900 (bearish <, bullish >)

Support: 6,800, 6,700

What we think people will try to monetize here is the vol pop more-so than SPX upside (i.e. delta). Relatedly, puts are now a bit expensive, and so anyone looking to add protection after the move should look at put spreads or put flies.

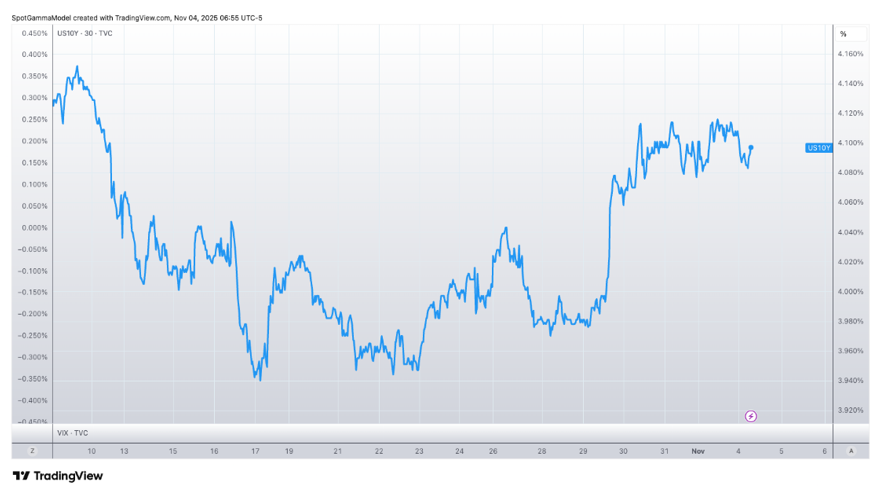

Lastly, let me include a note on the credit market. Credit market problems are often the source of the biggest equity vol, as bond holders scramble to buy puts to hedge out defaults. There are a few credit market headlines percolating, but the bigger thing for the immediate term was the move higher in rates post-FOMC meeting.

You see that here with the 10-Year Treasury Yield going from 3.9% to 4.1%. Bond/rate sensitive ETFs were heavily call-bid into FOMC, and flipped to put-bid post FOMC.

Now, though, we are seeing a flip back to calls in these assets. This suggests either a tone change back to thinking rate cuts are coming in December (and implied market support). This call-skewed look is better for equity bulls, at least for now.