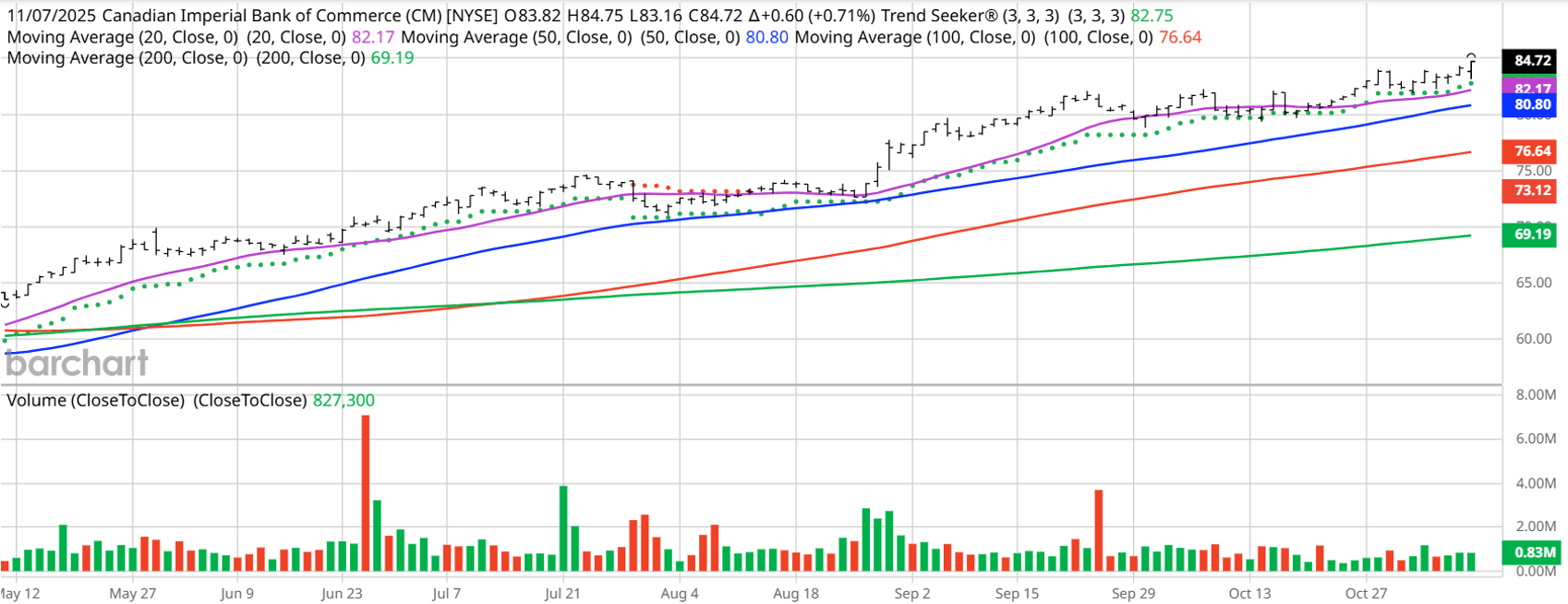

Valued at $78.6 billion, Canadian Imperial Bank of Commerce (CM) is a leading North American financial institution that offers a full range of products and services across Canada, the US, and the rest of the world. Since the Trend Seeker tool signaled a new “Buy” on Aug. 13, the stock has gained 15.9%, highlights Jim Van Meerten, analyst at Barchart.

CM has a Weighted Alpha of +40.7 and a 100% “Buy” opinion from Barchart. The stock has gained 32% over the past year. The Relative Strength Index (RSI) is at 69.1 and there is technical support around $83.67.

Canadian Imperial Bank of Commerce (CM)

Don’t forget the fundamentals. It sports a 14.1 trailing price-to-earnings ratio and a 3.2% dividend yield. Earnings are estimated to increase 14.3% this year and an additional 7% next year.

The Wall Street analysts tracked by Barchart have issued four “Strong Buys,” two “Moderate Buys,” and six “Hold” opinions on the stock. CFRA’s MarketScope Advisor rates it a “Buy” with a price target of $96. Some 728 investors following the stock on Motley Fool think the stock will beat the market while only 137 think it won't.