On balance, there’s little doubt the evidence has worsened, as the broad market continues to have issues (elevated new lows, slipping breadth, etc.) and more air pockets are emerging for some leading titles. Still, we like Corning Inc. (GLW) here, notes Mike Cintolo, editor of Cabot Top Ten Trader.

Most leaders didn’t crack. Some actually raced higher after earnings. So, the question is whether a “real” correction is getting underway – or if this will be yet another shakeout-type decline that gives way to higher prices.

So far, of course, it’s looking like the latter. But we’ll stay flexible as we see whether a year-end run is getting underway or whether more volatility is coming.

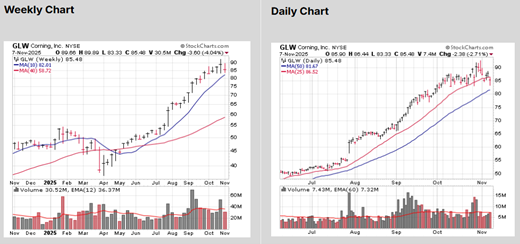

As for GLW, it’s a steadier leader in the Artificial Intelligence (AI) and solar space. It’s testing its 10-week line for the first time — look to enter on strength and use a tight-ish stop.

GLW had a strong rebound from its early April low, launching a smooth run-up for the next three months as it approached its high in July. The breakout came right after that, thanks to Q2 earnings. Shares overcame resistance and ran into the upper 80s by early October. Since then, GLW has bounced around but hasn’t made any net progress, digesting its gains while the 50-day line catches up. We’ll look to enter on a bit more strength.

Recommended Action: Buy GLW.