Sometimes you need to look backwards to see the future. Back in August, we showcased two rare signals that will power small caps to all-time highs. Now, it’s time to trade that new leadership in 2026, advises Lucas Downey, co-founder of MoneyFlows.

Small caps were not a consensus idea in August. But we made this bold claim after two setups occurred. First, the S&P Small Cap 600 surged 3.8% in a session on Aug. 22. Second, we noted that interest rate cuts will restart after a five-plus-month pause from a prior cut.

Today’s signal study will take our constructive stance a step further. Over the past 13 sessions, the S&P Small Cap 600 has surged a crowd-stunning 10.5%. Incredibly, the last time we saw a similar gain over the same time frame was coming out of the tariff crash.

Now, using the eye-ball test we can visually note how in April small caps continued powering higher after this double-digit surge. But we don’t rely on eyeballs for our signals at MoneyFlows. We study history and evidence.

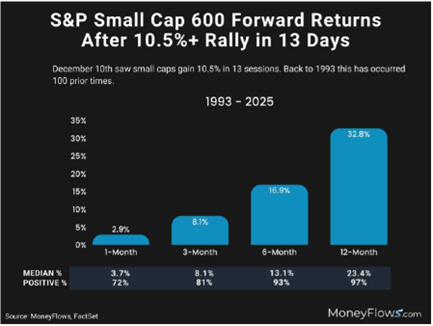

Back to 1993, we found 100 instances where the S&P Small Cap 600 gained 10.5% or more in a 13-day span. Here’s why you’ll want to buy small cap stocks aggressively in 2026:

- One month later, small caps jumped 2.9%

- Three months later, small caps leaped 8.1%

- Six months later, small caps powered higher by 16.9%

- 12 months later, they surged 32.8% on average

As we approach 2026, you’re going to want to tilt your portfolios toward smaller stocks. Lower interest rates mean new leadership and all-star opportunities not found on the lips of the media.

Rotations bring opportunity. You just need a map to see it!