Last week was a mixed one in the markets, with the Nasdaq and many big-cap, AI-type names stagnating while the broad market did very well. Guardant Health Inc. (GH) has pulled back the past three weeks to the century mark, making it a solid trade here, says Mike Cintolo, editor of Cabot Top Ten Trader.

Small- and mid-cap indexes rose 2.5% to 3.5% on the week, with more stocks hitting new highs. While cyclical and some defensive names did improve, some non-AI growth areas that mostly sat out the past nine to 12 months did as well.

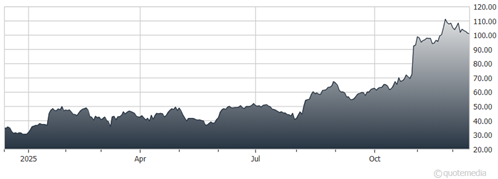

Guardant Health Inc. (GH)

All told, the intermediate-term trend for the major indexes is now pointed up, with most of the indexes we track at new highs. As trend followers, we obviously can’t ignore that. And it’s clear the initial broad market thrust seen off the Nov. 20 lows has some legs.

That said, there are still many crosscurrents out there, not the least of which is the Nasdaq. It was the leader in the post-April move, but is now lagging and hitting resistance as rotation sets in. Even the S&P 500 Index (^SPX) is battling with its prior highs. Many growth funds and indexes (not just AI) are in the same boat, moving up solidly from the lows but failing to confirm an intermediate-term uptrend.

As for GH, its pullback looks like a normal exhale following its huge run. You could buy some here or (preferably) on a bit more weakness, with a stop in the $87 area.