Hardly a day goes by now without another geopolitical shocker – from the Maduro raid in Venezuela to claims and counterclaims over Greenland. But setting politics aside…and looking only at markets…how are single-country ETFs handling it all?

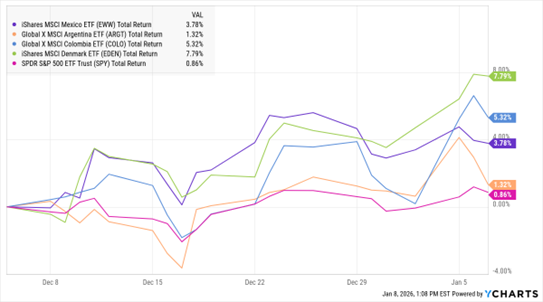

Check out today’s MoneyShow Chart of the Day for some answers. It shows the recent performance of ETFs that track markets in Mexico, Argentina, Colombia, and Denmark compared to the SPDR S&P 500 ETF Trust (SPY).

President Trump has chided leaders in Mexico and Colombia, while coming to the aid of Argentina’s president Javier Milei. Greenland is currently an autonomous territory of Denmark (and no, it doesn’t have its own ETF!)

EWW, ARGT, COLO, EDEN, SPY (1-Mo. % Change)

Data by YCharts

So far, the iShares MSCI Denmark ETF (EDEN) is leading the one-month performance race, gaining 7.7%. The Global X MSCI Colombia ETF (COLO) is next, with a gain of 5.3%, while the iShares MSCI Mexico ETF (EWW) is up 3.7%. Both the Global X MSCI Argentina ETF (ARGT) and the SPY are up roughly 1%.

What can you glean from this action as a trader? You could say it shows markets are relatively sanguine about all the political rhetoric and recent action. Investors might be expressing a view that no more dominos will fall. After all, Trump and Colombia’s president Gustavo Petro just spoke in a call both characterized as positive.

Or you could argue the action demonstrates a different MARKET-based point-of-view. Namely that greater American involvement in local affairs (or a big payout for and future investment in Greenland) could be positive for companies that are based or trade in Latin America and Denmark. As the Financial Times noted yesterday, Greenland-linked stocks that trade in Denmark – including the island’s biggest bank – surged this week.

In any event, these ETFs will be the ones to watch closely as conflicting headlines fly in the days and weeks ahead.