Japanese stocks surged to record highs this week, while the yen weakened and bond yields rose on reports that Prime Minister Sanae Takaichi may call snap elections soon. The WisdomTree Japan Hedged Equity Fund (DXJ) and iShares MSCI Japan ETF (EWJ) are two ETFs to consider, notes Neena Mishra, director of ETF research at Zacks Investment Research.

Takaichi is hoping to convert her high approval ratings into a parliamentary majority for her party. The Nikkei, which has been rising since Takaichi became Japan’s first female prime minister in late October, significantly outperformed the SPDR S&P 500 ETF (SPY) last year. Takaichi is known as a protégé of former Prime Minister Shinzo Abe and a supporter of Abenomics.

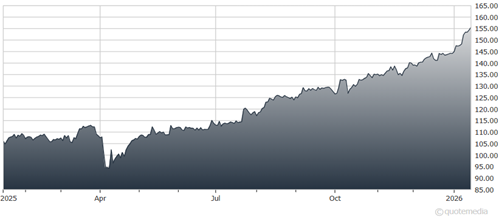

WisdomTree Japan Hedged Equity Fund (DXJ)

Investors are hopeful that Takaichi will introduce aggressive fiscal spending, including increased defense outlays and tax cuts to support economic growth. She has also pledged to boost investment in high-growth areas such as Artificial Intelligence (AI) and semiconductors. Overall, her policy agenda appears supportive of Japanese equities, and the market is optimistic about the so-called Takaichi trade.

Moreover, Japan’s stock market was already performing well before the election. Improved corporate governance and more shareholder-friendly policies have attracted global investors back to Japan. The country is seeing a strong reflationary trend, with growth, wages, and prices all on the rise.

Warren Buffett’s endorsement has also supported Japanese equities. The Oracle of Omaha began investing in five Japanese trading houses in 2019 and has compared their diversified business models to Berkshire Hathaway (BRK.B) itself.