The S&P 500 Index (^SPX) finished slightly lower last week as headline price paused. But the broader market continued to display underlying strength. On balance, activity reflected a market in transition rather than retreat, with leadership rotating away from funds like the Invesco QQQ Trust (QQQ), observes Buff Dormeier, chief technical analyst at Kingsview Partners.

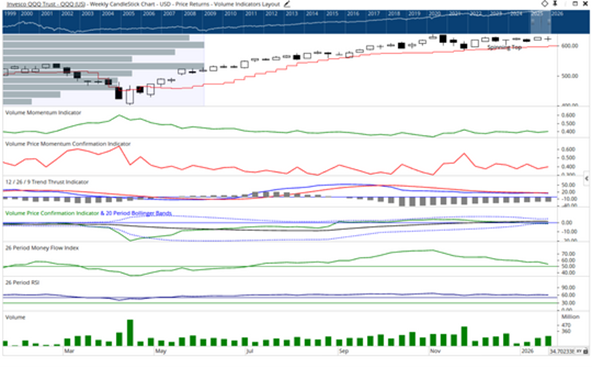

Participation widened beneath the surface – and leadership reflected this shift. The “generals,” represented by the QQQ, led the decline within the narrow leadership cohort, finishing down 0.8% on the week. In contrast, the Invesco S&P 500 Equal Weight ETF (RSP) finished higher by 0.6%.

For the week, S&P 500 Capital Weighted upside and downside volume finished essentially even on average volume, signaling near parity between buying and selling pressure. Capital Weighted dollar flows, however, leaned defensive, with 62% of flows to the downside.

Invesco QQQ Trust (QQQ)

The accumulated NYSE Advance–Decline Line broke through resistance to register new all-time highs, following last week’s all-time highs in the Advance–Decline Line of NYSE operating companies only. These developments reinforce the view that participation is expanding even as headline indices consolidate.

Bottom line: The action underscores a market that is rotating rather than rolling over. Leadership is dispersing, participation is expanding, and capital is reallocating across the formation, consistent with the theme of broadening exposure without excess.

At the same time, capital flows into the S&P 500 remain cautious, and volume confirmation has not yet followed price to the same degree. In this environment, discipline remains essential. Traders should respect the signals of rotation, maintain diversification, and remain attentive to support levels as leadership continues to evolve.