The chase is clearly back on, after vols have mildly reset. The iShares Russell 2000 ETF (IWM) made new-all time highs Wednesday, as did the VanEck Semiconductor ETF (SMH). That's not something that happens in the midst of a risk-off spasm. If the S&P 500 Index (^SPX) moves back below 6,890, we flip back to risk-off, writes Brent Kochuba, founder of SpotGamma.

Vols are now back to where they were on Friday night, as you can see by comparing SPX 2/20 Exp skew from Thursday morning versus Friday's close. This basically marks the resolution of the Greenland issue - a problem that didn't really exist before last week. Interestingly, the SPX is now back into the 6,900-6,950 box, which was the same place we were in before Greenland was an issue.

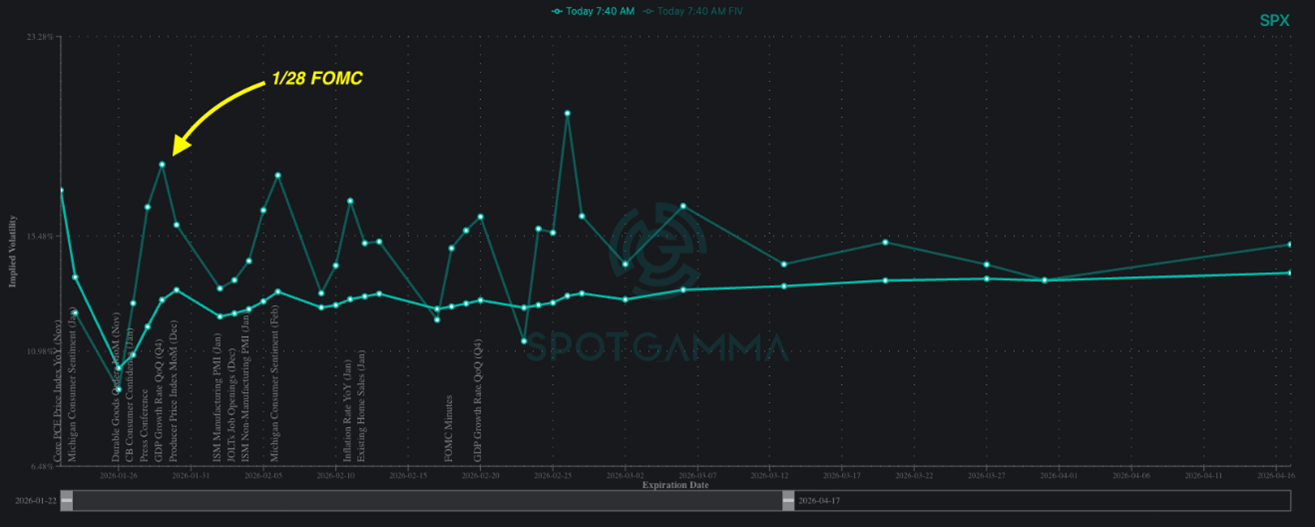

None of this resolves the event vol tied to the Jan. 28 Federal Reserve meeting. That event is going to hold up vols, as you can see by comparing our Forward IV (light teal) to the SPX (teal). Essentially what we have here is a window for traders to smack down 0-3 DTE vol, but they are likely to stay off of expirations after Jan. 28.

This means that we can have some light, local vol selling, which now helps to keep SPX >6,900. But we aren't going to marry equity long positions until post-FOMC.