Almost all the line items in Microsoft Corp.’s (MSFT) fiscal second quarter looked great. But the stock melted down the most since 2020 anyway. Why? It all goes back to worries about AI spending.

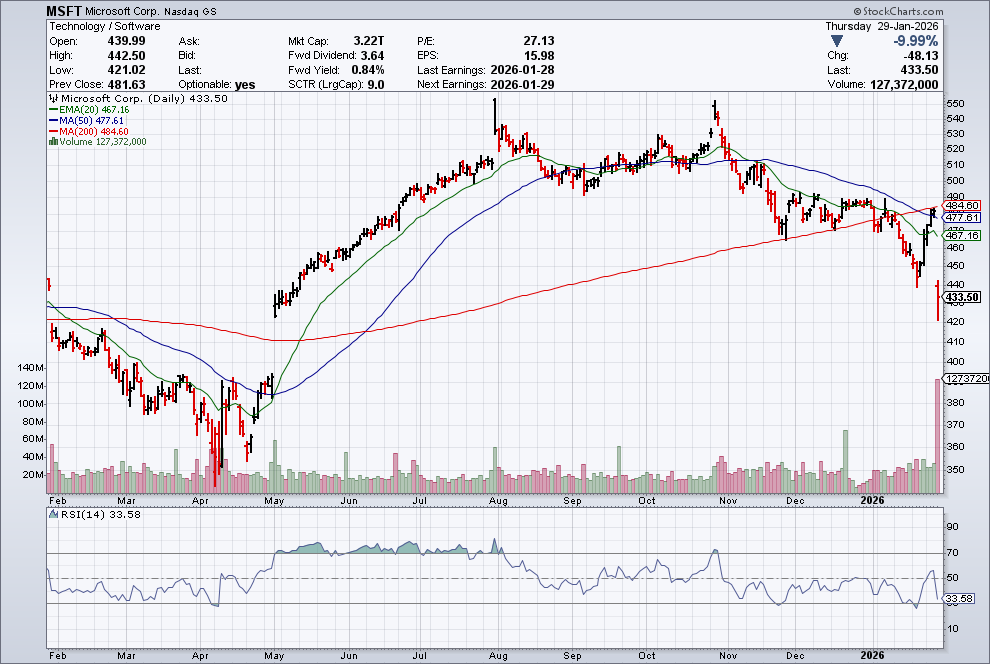

Take a look at the MoneyShow Chart of the Day, which shows Microsoft stock going back 12 months. You can see that MSFT was already losing momentum, with RSI peaking last summer and the shares making a series of lower highs in Q4 2025. But yesterday’s breakdown on massive volume REALLY stands out!

Microsoft Corp. (MSFT)

Source: StockCharts

So, what happened? Let’s start with the positives from Microsoft's report. Profit came in at at $38.5 billion, or $5.16 per share. That beat analyst estimates. Revenue came in at $81.3 billion. That also beat estimates. Operating income? Same story.

But here's the thing: Capital expenditures soared 66% year-over-year to $37.5 billion. At the same time, sales growth at its Azure cloud computing division slowed just a bit to 38%.

That dredged up lingering concerns that Big Tech is spending oodles of cash on data centers, Artificial Intelligence model development, and human capital…but that all of the upfront investment might not generate enough profit down the road. While Meta Platforms Inc. (META) also reported results – and did just fine – the net effect was for tech stocks to slide. The State Street Technology Select Sector SPDR ETF (XLK) is now basically unchanged since October.

Clearly, the AI story isn’t going away. But neither are AI spending worries. Keep a close eye on this leadership group – because if it continues to struggle, the markets probably will, too.