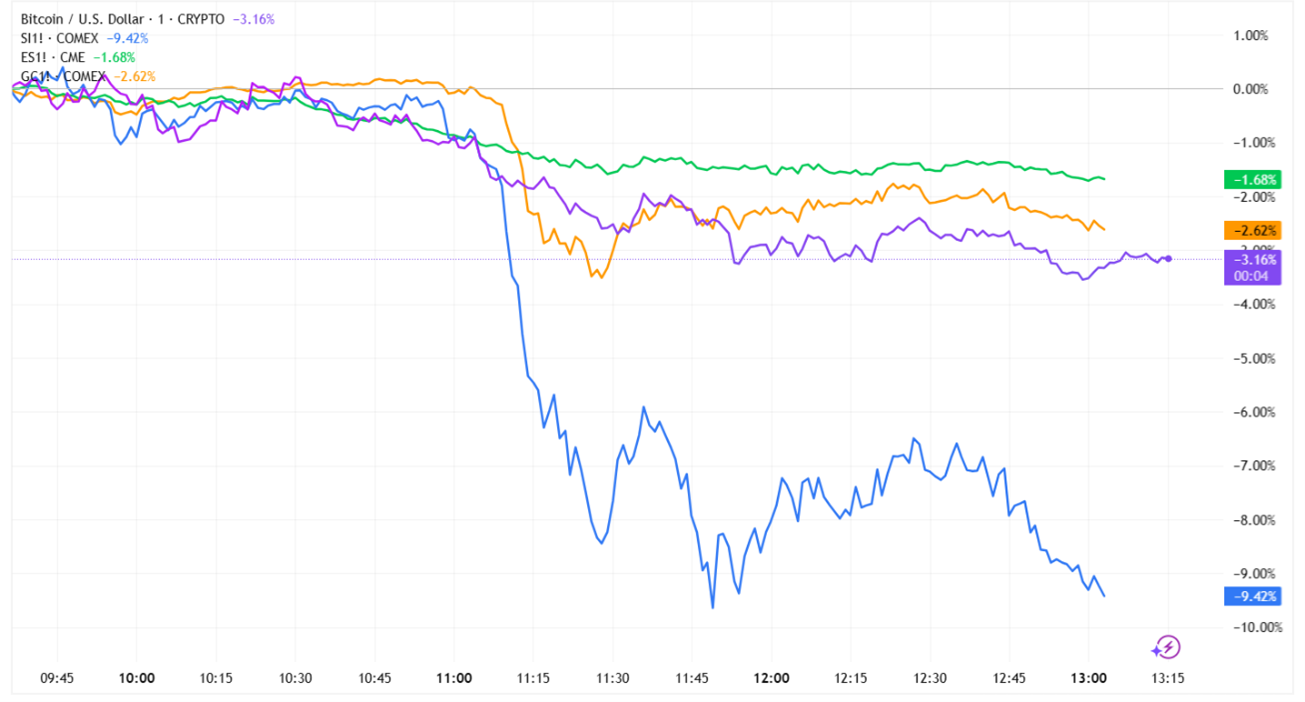

It happened again yesterday. A silver “Flash Crash” that sent the metal down 11% in minutes. Gold suffered a similar (though smaller) slump, while equities sold off all day long. That volatility is keeping traders on edge…and rightfully so.

Take a look at the MoneyShow Chart of the Day. It shows the intraday trading action in spot Bitcoin and silver, gold, and S&P 500 E-mini futures yesterday morning and early afternoon. You can see that this was a cross-asset-class move, even as the percentage declines were smaller outside of silver.

Bitcoin, Silver, S&P 500 E-minis, Gold (Thursday Intraday Chart)

Source: TradingView

What happened? Was it a broader “risk out” move? Part of a big rotation trade into bonds? A reaction to recent AI-driven washouts in SaaS stocks and financial services providers, plus yesterday's wipeout in TRUCKING names?

I didn’t see any great explanations myself. But I DO know one thing: seemingly unprovoked sudden, violent moves in any asset class can shake confidence. When you see them in multiple markets, that’s even more concerning.

I’ve been saying for a while that the first quarter of 2026 – and maybe the entire first half – will be choppier than we've gotten used to. So, have MoneyShow experts like Jeff Hirsch. With market action now validating that forecast, be sure to account for it in your trading plan!