Palantir Technologies (PLTR) — a new recommendation for our model portfolio — is a software company specializing in big data analytics, suggests global investing expert Carl Delfeld, editor of Cabot Explorer.

Peter Thiel and a few others from PayPal (PYPL) founded Palantir in the early 2000s. Its software is used by government agencies in a wide range of applications and the company sees plenty of room to expand into the commercial sector.

The Colorado-based company offers three platforms: Palantir Gotham, used primarily by government agencies; Palantir Metropolis for banks, financial services firms and hedge funds; and Palantir Foundry, used by corporate clients.

The company’s commercial customer target sectors are health care, energy and manufacturing sectors. Government agencies, the chief growth driver, use Palantir software for intelligence gathering, counterterrorism and military purposes.

Palantir recently announced that it is expanding its strategic partnership with the U.S. Space Force and U.S. Air Force, proving its ability to offer cutting-edge technologies. As part of the new deal, the company will provide software for powering advanced critical missions and support the Space Command and Control program.

The company’s solutions will also provide senior leadership at the Air Force with an analytics platform that merges data sources from across the Service. The total value of the contract is $32.5 million.

Palantir and IBM (IBM) announced a global partnership earlier this year, making Foundry software available to IBM’s cloud computing customers.

On May 11, the company posted its first quarterly profit as a public company, with revenue up 49% to reach $341.2 million. In America, revenue grew 83% in the U.S. government and 72% in commercial.

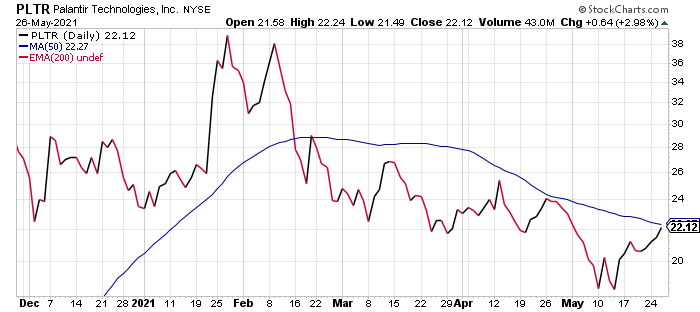

PLTR stock is more than 45% off its January 27 peak but it’s up nearly 200% since going public in September 2020 at $7.25 a share. The stock has been in an uptrend and demonstrating relative strength.