There is good reason for uncertainty at this time with high inflation and the Russia/Ukraine crisis; but in the end, I still strongly suspect this proves to be just another short term detour on a long term bullish highway, asserts Steve Reitmeister, editor of Reitmeister Total Return — and a participant in The Interactive MoneyShow Virtual Expo on March 22-24. Register here for free.

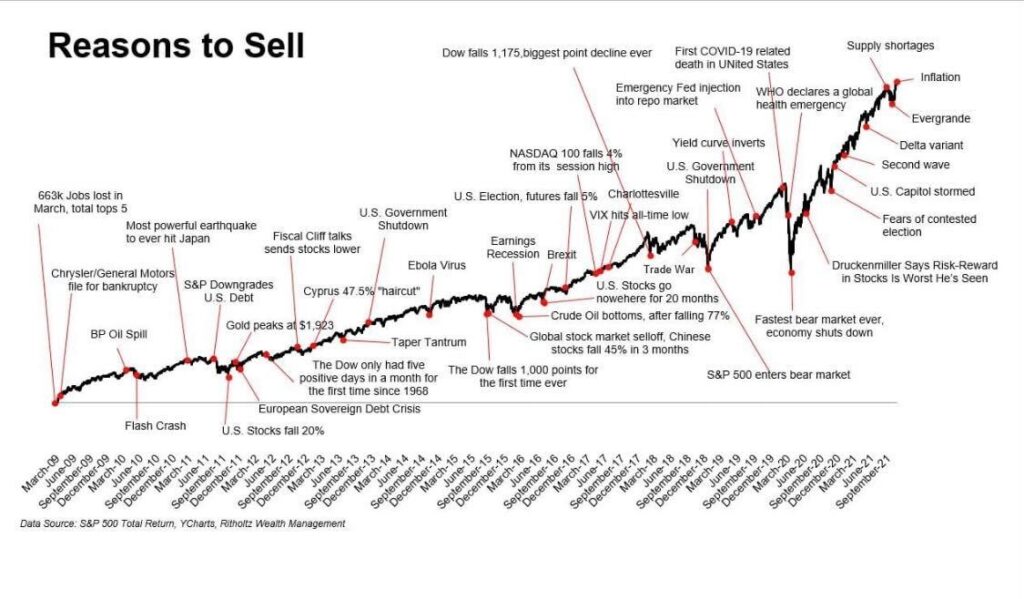

Let’s start off with this interesting chart entitled “Reasons to Sell”… but to be honest, it should end in a question mark as it points out time and time again why short term negatives that led to numerous pullbacks and corrections were nothing more than buy the dip opportunities.

10-year Treasury rates still yield half of the historic norms around 4%, which gives a strong bias to stock ownership. This concept in many ways supplies a floor under stock prices which is why I think 4,000 will prove to be an area of strong support.

However, I can also picture a scenario where investors need to push things to the brink of bear market territory. That would be a 20% drop from the all time highs down towards 3,854. That could be a quick intraday move that sparks a violent, and likely, lasting bounce.

Meanwhile, I'm looking get a quality pick back in the mix in our trading portfolio that also fills out our need for a bit more tech and a bit more large cap, lower beta exposure.

With these considerations, why not buy Microsoft (MSFT)? Yes, there was a time that Microsoft was getting left in the dust by the rest of the FAANG folks. However, they have clearly righted the ship with a focus on the cloud and other wise moves that have led to one of the most impressive strings of beat and raise quarters.

So even though business is in great shape, MSFT shares got caught up with the rest of the tech group in an oversized correction that has pushed shares down from a recent high near $350 to about $280. So just making it back the previous highs is an attractive 25% upside.

Gladly, the value story is even better than that. After their most recent beat and raise quarter we see the average target is $376 with one top rated analyst pounding the table for $411.

All in all, I just wanted a bit more large cap, lower beta exposure in the portfolio. The fact that it also comes wrapped in a consistent growth tech stock story like MSFT is just a bonus.