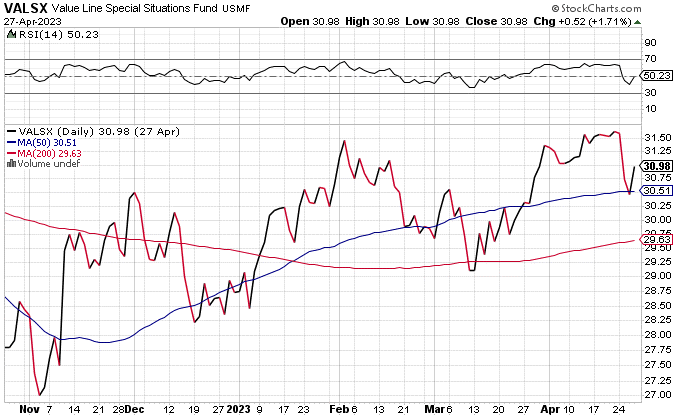

Regional bank worries resurfaced recently after First Republic Bank reported that deposits had dropped by about 40% in the first quarter. But we’ve been expecting this volatility. Meanwhile, for domestic stock funds, one of my two new Buys this week is Value Line Premier Growth (VALSX), explains Brian Kelly, editor of MoneyLetter.

First Republic stock plunged nearly 50% last Tuesday and about 30% on last Wednesday. This negative news came on a day which featured some positive earnings reports from big name tech stocks.

Microsoft (MSFT) posted beats on the top and bottom lines for the first quarter and gained 7.2%. Google parent Alphabet (GOOGL) reported better-than-anticipated earnings as well. After two consecutive weeks of across-the-board gains, all our major global indices posted declines for the reporting period.

Since the last Hotline, the S&P 500 was down 2.4% (April 20 – April 26); the Euro Stoxx 50 dropped 1.1%; the Nikkei 225 was down 0.7%; the Shanghai Composite finished 3.1% lower.

In short, we are living through the volatility we’ve been expecting. This will continue until Fed policy and the timing of an interest rate hiking pause becomes clearer. Maintain your current asset allocations.

There were also two fund upgrades announced recently: In the Fidelity Conservative model Sold Fidelity Mid Cap Value (FSMVX); with the proceeds Bought Fidelity New Millennium (FMILX). In the MoneyLetter Conservative and Venturesome models, Sold Muhlenkamp (MUHLX) and Bought Artisan Value Investor (ARTLX).

Recommended Action: Buy VALSX.