Homebuilder Lennar Corp. (LEN) is the latest new position in our portfolio, explains Mark Skousen, growth stock expert and editor of the specialized trading service, Fast Money Alert.

Lennar is the second-largest public homebuilder in the United States, based on the number of delivered homes. The company’s homebuilding operations target first-time, move up, and active adult homebuyers mainly under the Lennar brand name.

Lennar’s financial-services segment provides mortgage financing and related services to its homebuyers. Miami-based Lennar is also involved in multifamily construction and has invested in numerous housing-related technology startups.

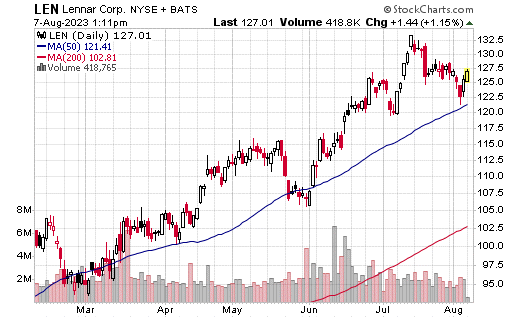

Shares of the homebuilder have been red hot of late, up some 12% in the past three months and 40.4% year to date. The recent broad selling in the stock market helped push LEN shares to an attractive price that we’ve been waiting to take advantage of.

Fundamentally, LEN is set to benefit mightily from the current conditions in the housing market. Recently, the Commerce Department reported that construction spending increased 3.5% in June 2023 vs. June 2022. Spending on private construction projects increased 0.5%, with investment in residential construction rising 0.9% after rebounding 2.9% in May.

Perhaps more importantly, the United States continues to experience a long-term housing shortage, with the construction of new homes failing to keep pace with the growing population.

Moreover, now that interest rates are higher than they’ve been in decades, that’s driving up mortgage rates. Higher rates mean more homeowners are staying put, and that’s keeping existing homes off the market, driving additional demand for newly built homes.

On Sept. 19, we will find out just how well LEN did in its current quarter. If, as we suspect, the numbers will be robust, then getting into this one now -- as the shares run up higher into earnings — will prove to be a prescient and profitable move. So, let’s buy with a protective stop set at $103.00.