The global bond sell-off continues to gain momentum, driving yields higher...and gold through the key $1,900 support. In other words, the bears are winning right now. And I’m not talking just about gold, opines Brien Lundin, editor of Gold Newsletter.

I guess it’s somewhat comforting to blame a juggernaut like the global bond market for destroying my claim that gold had bottomed in early July. But it does nothing to alter the cold, hard fact that spot gold just tested the $1,900 level...and failed the test.

As you’re probably aware, I have the somewhat controversial view that the Dollar Index doesn’t drive gold. Rather, both the dollar and gold are being strongly influenced by Treasury yields and, by extension, Fed policy (which is really the primary driver behind every asset market in today’s world).

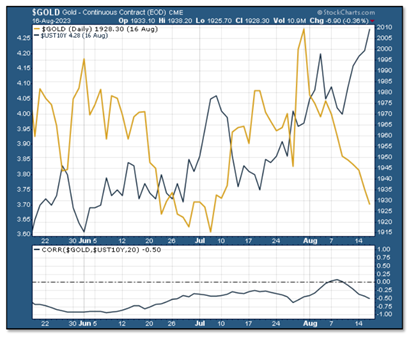

Consider the following chart. I show gold futures plotted against the 10-year Treasury yield, with the rolling 20-day correlation below. As you can see, the correlation between gold and the 10-year yield is strongly negative at -0.50.

Interestingly, gold was rising in July even as yields were also gaining, because investors were beginning to price in the end of this rate-hike cycle. That’s why I called a bottom in gold and a new rally. Unfortunately, the 10-year yield went into overdrive as the aforementioned global bond sell-off spread, and even gold has been unable to resist this headwind.

It’s apparent to me that Fed policy, as manifested by the 10-year yield, is the bus. If the Dollar Index is having any influence on the gold price, it’s because the direction of yields is pushing the greenback first.

The key question now is what this means for gold going forward. I was actually encouraged by an early-session rise in gold recently because it showed that $1,900 was a key buy-stop for some big investors. I’m hopeful that we’ll get some bit of bad news for the economy that will get gold back above the bar in the near term, and essentially negate this downtrend.

The chartists will tell you that gold falling through $1,900 means that $1,840 or thereabouts is the next target. I’m not so sure since, again, it all depends on what happens with Treasury yields (which I don’t think can go much higher on this run).

If you haven’t guessed by now, I remain bullish on the sector over the longer term. While we have no idea where the gold price will be tomorrow or next week, I’m fairly confident it’s going to be significantly higher this fall...and will challenge the record high by early next year.