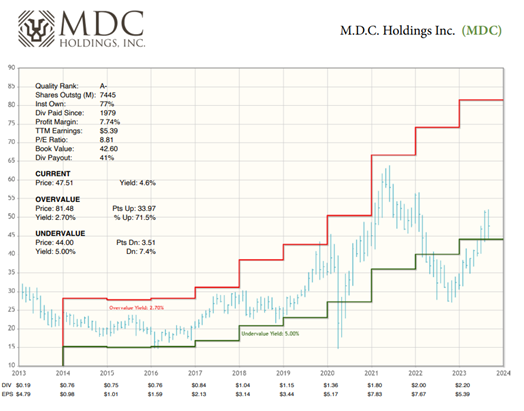

As has been the case for some time, there is only some minor movement in my “Timely Ten.” M.D.C. Holdings (MDC) makes a return to the TT due to its internals and a drop in share price, which reduces downside risk and increases upside potential, says Kelley Wright, editor of Investment Quality Trends.

MDC, through its subsidiaries, engages in the homebuilding and financial service businesses. Its homebuilding operations include purchasing finished lots or developing lots for the construction and sale primarily of single-family detached homes to first-time and first-time move-up homebuyers under the Richmond American Homes name.

The company conducts its homebuilding operations in Arizona, California, Nevada, New Mexico, Oregon, Texas, Washington, Colorado, Idaho, Utah, Alabama, Florida, Maryland, Pennsylvania, Tennessee, and Virginia. Its financial services operations comprise originating mortgage loans primarily for homebuyers, providing insurance coverage primarily to its homebuilding subsidiaries and subcontractors for homes sold by its homebuilding subsidiaries, and for work performed in completed subdivisions.

Of MDC’s two major areas of operation, homebuilding and finance, homebuilding is the larger revenue generator as finance only contributed 3% of the total revenue in 2022. While there has been an underproduction of new homes over the past decade, homebuilding is still a cyclical industry, and is impacted by inflation concerns, the Federal Reserve’s continued tightening, mortgage interest rates, consumer confidence, and the current geopolitical environment. MDC was founded in 1972, is headquartered in Denver, Colorado, and has paid dividends since 1979.

We last looked at MDC in the July 2022 issue, so enough time has passed to include its chart in this issue. One thought on MDC. As I alluded to elsewhere, there have been some cracks in housing recently, and as a homebuilder MDC would be susceptible to any weakness in that sector.

The 30-year mortgage has crept into the 7% area, and MDC does provide financing, so this may be the explanation for the drop in share price.

Recommended Action: Buy MDC.