Stocks continue to come under pressure from rising interest rates, thanks in part to speculative statements from people like JP Morgan Chase (JPM) CEO Jamie Dimon that the Fed Funds rate may reach 7%. But I think we will soon see a significant quick bounce in rate-sensitive stocks, especially if money leaves the technology sector. A great way to play this is American Electric Power (AEP), advises Hilary Kramer, editor of Premium Services - Hilary Kramer.

With retail and restaurant chains reporting slower consumer spending, I believe the Federal Reserve will at most raise overnight rates another 0.25% from here. I am looking for a quick bounce in AEP as a result.

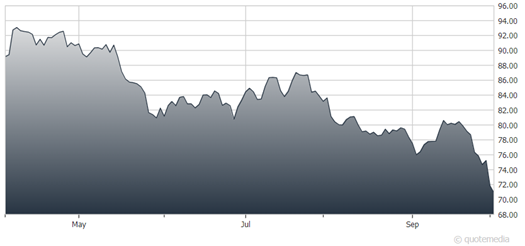

AEP is a regulated utility which operates primarily in Texas, Virginia, Ohio, and Kentucky. The stock is down nearly 30% from Its April high of $96.05, and now valuation is very attractive at 13.6X EPS estimates to support a dividend yield of 4.6%.

American Electric Power (AEP)

Investments in clean energy in its regulated base should allow earnings and its dividend to expand 6% to 7% in the future. When you take this growth into account, the current yield here is extremely attractive compared to a fixed 10-year Treasury yield around 4.72%, which will likely decline significantly if the economy cools.

From a technical standpoint, the stock appears to be washed out, with a Relative Strength Index (RSI) of 23.6 (30 or lower is considered to be very oversold) and trading close to 3 standard deviations below its 50-day moving average.

Recommended Action: Buy AEP.