Logistics and shipping is one of the most complex businesses one could imagine. It takes a special kind of business to understand what it takes to move goods around the world in the most timely and cost-effective means possible. Expeditors International of Washington (EXPD) is a sector star worth investigating, notes Tyler Crowe, author of Misfit Alpha.

When most investors consider transportation and logistics investments, they gravitate toward the familiar: UPS (UPS) and FedEx (FDX). They are ubiquitous players in the industry, and most of us frequently see their delivery trucks.

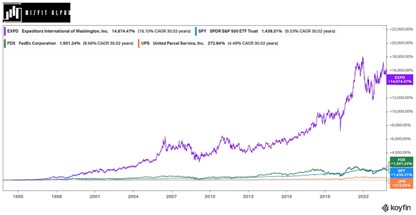

I certainly wouldn’t judge anyone too harshly for thinking these are great businesses. However, I believe this familiarity bias toward the most consumer-facing transportation and delivery companies means investors are missing some of the better firms in the logistics industry. For example, since 1992, when FedEx went public, EXPD generated a 5x return to FedEx. Expeditors International has similarly outpaced UPS 8.5x since its IPO in 1999.

EXPD is a global logistics company best described as an agent for your cargo. The core of its business involves freight consolidation. This means the company buys cargo space on a commercial airline or an ocean-going vessel and consolidates several customers’ cargo into the allotted space. The company also acts as a representative agent for most of its clients to handle things like customs clearance, warehousing & storage, distribution, and some high-touch services for unique deliveries.

What is rather peculiar about this business is Expeditors doesn’t own any planes, ships, or containers. The company does everything as a third-party agent or representative for its customers. It doesn’t necessarily compete with UPS or FedEx, either. Most customers are businesses shipping products or critical supplies rather than small packages and parcels.

As you might expect, a company with decent cash flow and marginal capital needs has lots of excess cash. It has been consistently repurchasing stock with those excesses. The board of directors has granted authorization to reduce the share count since 2001.

Expeditors International is also another company that makes the case for seeking out companies with lifer CEOs. Current CEO Jeffrey Musser started in 1983 as a part-time messenger and has worked up the ranks from there. A company that engenders an employee's loyalty for 40 years certainly speaks to its culture.

Sure, Expeditors International has its warts. We are in the midst of a significant shift in global supply chains. Nearshoring and any phrase indirectly saying “less reliance on China” will drastically alter the movement of goods over the next decade. But EXPD is an example of how digging deeper into an industry can unearth much more lucrative investments for those willing to put in the additional effort.