Two important inflation reports were released recently. Both indicated that overall pricing pressures have retreated from peaks in 2022. But both also confirmed that inflation remains above the Fed’s target of 2% -- and both indicated that progress to that level may be hard to achieve, advises John Eade, president of Argus Research.

Let’s first take a deeper dive into the Consumer Price Index. According to the latest CPI report, the overall inflation rate in March of 3.5% was higher than the prior month’s rate of 3.2%. That bit of bad news was compounded by a steady reading in the core CPI rate, which excludes the impact of food and energy and rose at an annual pace of 3.8% over the past year.

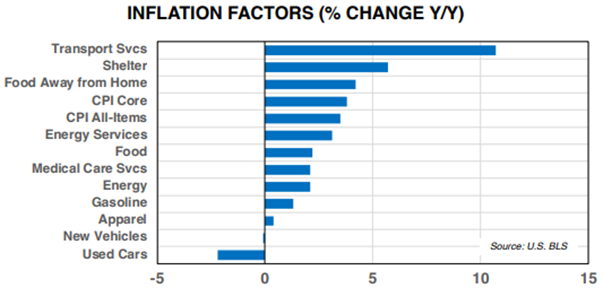

What’s propping up core CPI? Two main factors: Transportation Services (+10.7% YOY) and Shelter (5.7%). These elements of the index have prices that don’t typically fall sharply. Energy prices are also starting to tick higher.

The other inflation report was the Producer Price Index. PPI measures pricing trends farther up the supply chain, at the manufacturing level. Here, we see a modest decline in the rate of inflation on a monthly basis. For example, the core final demand PPI rate for March was 0.2%, compared to 0.6% in February and 0.4% in January.

How worrisome is all of this? We have noted for months that progress will be slow for inflation returning to the 2% level. And nothing was terribly alarming about either of the reports. Energy prices remain relatively subdued, and prices at the PPI Intermediate demand level -- farther up the value chain -- continue to outright decline.

We think the June 2022 CPI rate was the peak reading for the index this cycle, as the housing market cools, supplies of new vehicles are replenished, and the price of oil stays below $90 per barrel. The Fed has lifted the feds fund rate from 0% to above 5.25% over the past 18 months, and the rate hikes appear to be reducing inflationary pressures.

We look for the US central bank to be lowering rates in 2H24 and 1H25 as their concern shifts more toward economic growth.